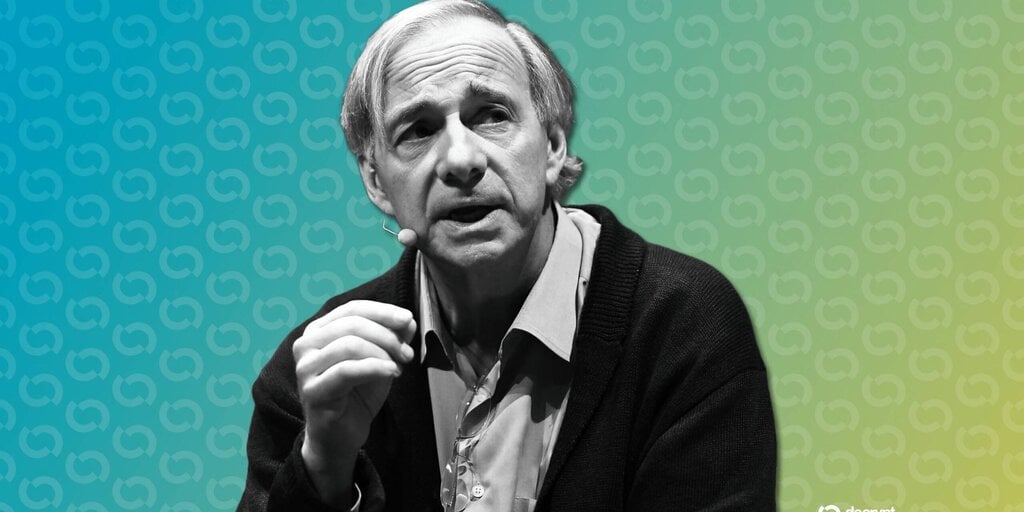

Dalio Recommends Significant Gold & Bitcoin Holdings Amid Macroeconomic Concerns

Ray Dalio, founder of Bridgewater Associates, has advised investors to allocate a substantial portion, proposing at least 15%, of their portfolios towards gold and Bitcoin as a hedge against macroeconomic headwinds not currently reflected in market prices.

In an interview on The Master Investor Podcast, Dalio warned that increasing national debts, exemplified by the US’s deficit and burgeoning interest payments, are not fully priced into current markets. He posits this creates vulnerability for significant future declines in asset values, particularly in government bonds and equities.

Dalio argued the US government’s persistent spending exceeds its revenues by 40%. This large debt accumulation, exceeding gross domestic product sixfold, requires continued debt issuance and corresponding central bank monetary expansion merely to fund interest payments, currently around $1 trillion annually.

He fears this environment may trigger severe market movements, suggesting that further rounds of quantitative easing or a government takeover of the Federal Reserve could serve as potent catalysts for a major economic crash. While acknowledging signs of such a scenario are “flashing or flickering,” Dalio attributes these views to his stance in “How Countries Go Broke.”

Gold or Bitcoin?

Insisting that traditional financial assets may not adequately provide safety, Dalio champions gold and Bitcoin as alternative diversifiers, offering protection against fiat currencies and cash equivalents. He exhibits a clear preference for gold over Bitcoin.

Dalio questions the likelihood of central banks adopting Bitcoin as a reserve asset, citing issues like lack of privacy due to transparent transactions and uncertainties surrounding the cryptocurrency’s fundamentally sound code or adaptability for robust monetary functions.

Dalio acknowledged holding both assets but emphasized that gold forms the dominant component of this hedge strategy due to these concerns. His Bitcoin allocation is described as “not much.” This preference aligns with a common view among traditional finance professionals who perceive even greater risks associated with gold than often communicated.

Finance experts surveyed concur they are unimpressed by Bitcoin as a hedge under adverse macroeconomic scenarios but maintain its bear market performance against gold, potentially attracting speculators. However, prominent gold analysts caution that gold’s historical performance can be disappointing during prolonged, severe bear markets and it remains significantly more volatile than often acknowledged.