Chinese e-commerce and technology giant Ant Group is reportedly exploring the integration of Circle’s USDC stablecoin onto its global blockchain payment platform, which serves over one billion users across Asia and beyond.

The integration timeline is contingent on USDC achieving full U.S. regulatory compliance following the recent passage of the GENIUS Act. According to Bloomberg, this background is crucial for Ant’s decision.

Integration Overview

Ant Group, parent company of Alipay – China’s dominant mobile payments platform with approximately 1.6 billion user accounts – aims to leverage stablecoins like USDC for potentially enhancing global payment efficiency. However, Ant’s initial focus is expected to remain on payment services rather than direct cryptocurrency transactions.

Source code from an individual familiar with the situation indicates that the integration plans hinge solely on the USDC’s compliance status in the United States post-GENIUS Act approval. An official confirming the matter added confirmation is pending timely US regulatory approval.

Ant International’s head of platform technology, Kelvin Li, stated at the Reuters Next conference that the firm “will not be focusing on crypto transactions” but instead emphasizes global payments. He believes stablecoins “are an important means” for providing efficient global payments and better customer experience.

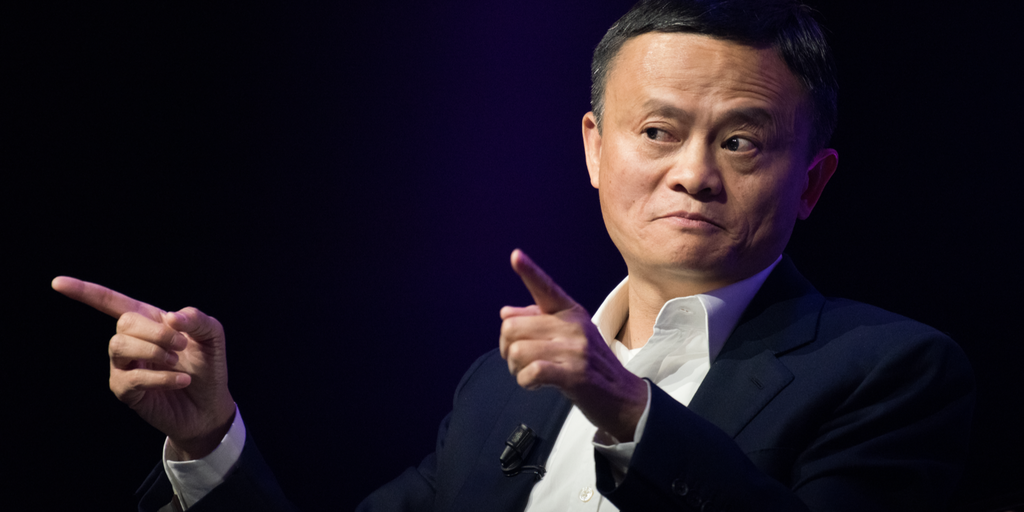

Ant Group Profile

Ant Group operates Alipay, the leading mobile payment platform in mainland China and widely used across Asia. Originating as a venture by Alibaba Group (one of China’s largest online retailers and cloud providers), its vast user base underpins its strategic move into blockchain infrastructure.

Regulatory Context

The developments unfold against the backdrop of increased regulatory clarity for stablecoins in the United States. The GENIUS Act, if enacted into law, is expected to provide the first clear U.S. legal framework for stablecoins, which is a prerequisite reported for Ant’s potential integration plans.

Broader Crypto Context

Meanwhile, Circle (USDC issuer), whose valuation has surged following the bill’s congressional approval (currently around $46 billion post-IPO), is positioned to potentially gain an edge over key competitors like Tether, as noted by some analysts, citing regulatory progress and adoption rates.

Neither Circle nor Ant has confirmed these reported plans at this time.