Circle Stock Soars on Buy Rating and Regulatory Clarity

Shares of Circle surged 14% in pre-market trading to over $236, briefly exceeding the $235 buy rating target set by Seaport Global, following the Senate’s passage of the GENIUS Act stablecoin legislation.

Key Developments

- Seaport Global initiated coverage with a “buy” rating and $235 price target, calling Circle a “top-tier crypto disruptor.”

- The GENIUS Act, passed by the Senate, establishes the first comprehensive federal framework for dollar-pegged stablecoins.

- Circle’s stock settled around $228, a 14% gain, after the market opened.

Seaport Global’s Positive Outlook

Seaport Global analyst Jeff Cantwell praised Circle’s stablecoin infrastructure, describing it as a “top-tier crypto ‘disruptor’.” Cantwell highlighted USDC’s foundational goal of creating a “HTTP for Money” to enhance global economic prosperity.

He forecasts significant growth in the stablecoin market, predicting it could expand from its current $260 billion valuation to $1 trillion by 2030. Cantwell anticipates Circle’s annual revenue could grow by 30% with gross margins around 40% as the company scales.

Cantwell acknowledged interest rate risk: “Nearly all of Circle’s revenue still comes from interest earned on reserve assets… This is both a strength and a risk if interest rates fall.”

Regulatory Framework

The Senate’s vote on the GENIUS Act marks a significant milestone. If signed into law, the legislation would establish the first comprehensive federal regulatory framework for U.S. dollar-pegged stablecoins.

Both Circle and Coinbase stand to benefit from regulatory certainty, particularly through their revenue-sharing agreement on the $61.2 billion in USDC cash reserves backing Circle’s stablecoin. Coinbase stock also showed strength, trading 3% higher.

Broader Market Movement

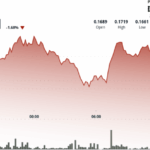

Robinhood experienced mixed trading, falling 1.65% despite hitting recent highs. The stock reached a 52-week high earlier Friday but has since pulled back, missing several key price target levels set by analysts.

Separately, Robinhood reported a substantial 89% year-over-year increase in total platform assets during May, reaching $225 billion.