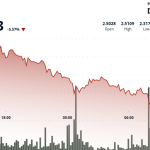

Israeli Airstrike on Iran Ignites Market Divergence: Bitcoin Drops as Gold Reaches Two-Month Highs

Following Thursday’s Israeli airstrike on Iranian nuclear facilities, high-tension geopolitical instability curbed risk appetite across global markets. Precious metals surged while investors shied away from risk assets. Tensions splintered market sentiment into “risk-off” and “risk-on” factions.

Brief Snap

- Bitcoin dropped while gold surged to two-month highs amidst escalating Middle East tensions.

- Over $1 billion in Bitcoin and altcoin positions were liquidated following news of the airstrike.

- Analysts highlight Bitcoin’s increasing correlation with risk assets during geopolitical crises, contrasting its divergence from traditional safe havens like gold.

Global markets registered significant movements late Thursday evening as Israeli fighter jets launched strikes on Iranian nuclear infrastructure. This event polarized investor reactions: one camp adopted a flight-to-safety strategy while another lost confidence in risk assets, particularly within the cryptocurrency sphere.

The ancient safe haven asset, gold, attracted capital flow as investors sought security amidst the Middle East conflict. However, Bitcoin, often branded as “digital gold,” saw its price decline, diverging significantly from the established safe haven trajectory.

Stephen Wundke, Director of Strategy & Revenue at Algoz digital asset investment firm, differentiated the trends observed Thursday: “The traditional buyers of gold are not in the crypto market yet,” Wundke told Decrypt regarding Bitcoin. He suggested gold, seen as a classic risk-off asset, would likely retain investor interest during conflict situations, should they arise. Furthermore, Wundke noted that gold’s gains began before definitive news confirmation of the Israeli airstrike.

Gold prices indeed climbed; initialCoinGecko data showed gold per ounce reach $3,427.90 on Friday morning. While Bitcoin slid 3.6% to around $103,900, gold’s ascent underscored the growing disconnect between the disparate assets during times of geopolitical shock. Monthly and year-to-date gold gains exceeding 7% and 46% respectively (data: Trading Economics) further highlight the contrast.

Jay Jo, Senior Research Analyst at Tiger Research, echoed these observations regarding cause and effect. Speaking on the correlation, Jo stated, “Bitcoin is sometimes seen as a safe haven, but in reality, it often moves in line with tech stocks rather than gold. Because of this coupling, Bitcoin and gold can show opposite price trends during geopolitical crises.”

Risk Reality Check

Simultaneously, the strike triggered substantial losses across many altcoins. Data from CoinGecko indicated liquidations exceeding $1 billion within 24 hours, predominantly involving long positions against assets like Ethereum, XRP, and Solana.

This sharp exit from risk aligns with the flight-to-safety behavior observed in conventional markets — gold, the U.S. dollar, and government bonds received inflows. Wundke of Algoz observed this sentiment shift, suggesting immediate catalysts weren’t necessarily the root cause. He mentioned the relative quietness of the cryptocurrency June lull, positioning the market in potential consolidation.

However, Wundke acknowledged ongoing geopolitical risks: a “significant escalation in the Middle East” could act as a definitive negative catalyst, potentially forcing Bitcoin radically lower.

Market sentiment had deteriorated sharply, reflected by a decline of ten points on the Crypto Fear and Greed Index (currently 61, leaning towards greed but showing moderation) and an investor expectation from DASTAN’s Myriad decentralized prediction market (Disclaimer: Myriad developed by Decrypt / DASTAN parent company) that sentiment is likely to stay below the neutral 64 level by week’s end.

Mike Novogratz, CEO of Galaxy Digital, contrasted the traditional gold narrative with the younger generation of investors gravitating towards cryptocurrency. Speaking Friday on CNBC, Novogratz implied that Bitcoin’s increased institutionalisation as a “macro asset” will eventually cause gold’s relevance as a risk-off asset to wane, driven by heavy demand from financial institutions like BlackRock.