When Joe Lubin led a $425 million investment to launch the largest corporate Ether treasury company, the comparisons to Michael Saylor were immediate.

Even Vitalik Buterin quipped that Lubin had become the “Mr. Saylor of ETH” at an industry event in Berlin this month.

At first glance, the similarities are clear. An obscure company begins ploughing millions into a cryptocurrency, boosting the token’s price along with the company’s shares.

But a closer look shows that amassing Ether on a listed firm’s balance sheet is actually quite different from the approach Saylor pioneered at MicroStrategy, now dubbed Strategy.

Different things

If Bitcoin was designed to be digital money, then Ethereum was invented to be an ecosystem for decentralised financial apps and ventures.

“We can also do so much more,” he said.

At the top of the list is staking.

Unlike Bitcoin, Ethereum relies on a proof of stake consensus model to validate and confirm various transactions on the blockchain. To become a so-called validator on the Ethereum network, users need to stake 32 Ether.

Validators earn rewards, or yield, for accurately confirming transactions. If they behave maliciously or dishonestly, such as validating fraudulent transactions, the network takes a small portion of the 32 Ether staked as a fine.

Staking yield

Now SharpLink Gaming, the company Consensys picked to be an Ether vehicle, is entering the staking arena in a big way.

As of June 13, SharpLink, an online sports betting company, has deposited more than 95% of its $463 million stash back into Ethereum to validate transactions.

The move is generating an average staking yield of 3%, which means SharpLink is raking in roughly $14 million on an annualised basis.

And the company, and by extension its stockholders, also benefit from any appreciation in the value of Ether.

‘They would learn quantum physics if they thought they could make reliable money on it.’

— Joe Lubin

Ethereum’s staking model also benefits from the high price of Ether.

The lower the value, the cheaper it would be for someone to buy and control a majority of the network’s validators and begin approving fraudulent transactions on the network.

The SharpLink manoeuvre has vaulted Lubin back into a precinct of the financial world he left long ago — Wall Street.

The Ethereum co-founder used to be a partner in the private wealth unit at Goldman Sachs, the white shoe investment bank.

As SharpLink’s new chairman, Lubin is now obliged to preside over quarterly earnings calls and engage with analysts and investors. He is keenly aware of the byways of the traditional capital markets.

As such, he is fascinated by how sophisticated investors will respond to his new Ethereum flywheel at SharpLink.

“Wall Street cares about one thing. They care about making money,” Lubin said. “They would learn quantum physics if they thought they could make reliable money on it.”

He hopes analysts will pore over his treasury strategy.

And the timing couldn’t be more critical.

Just as Bitcoin and Solana soared to all-time highs in the first quarter, Ethereum lagged far behind.

“Bitcoin ended up doing very well, partially because Saylor did a great job,” Lubin said.

“Solana did what they needed to do to get some attention, and that was all the meme coins. And Ethereum was kind of squeezed between.”

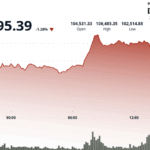

In fact, if you had bought Ethereum this time last year and held, you would be down 27% on your investment.

In April, the sluggish price performance turned many in the industry against the blockchain’s leadership.

Some DeFi users blamed the Ethereum Foundation, the network’s non-profit steward, for a development roadmap that didn’t accrue enough value to the blockchain. They demanded change.

Instead, they got Lubin and a dozen other crypto investment firms, including Arrington Capital and Galaxy Digital, to buy up more than 69,000 shares in SharpLink and turn the online sports betting company into the second-largest holder of Ether after the Ethereum Foundation.

“It took an external shock from how Bitcoin was doing compared to Ether, and how Solana was doing compared to Ether, to wake up,” said Lubin.

Major plunge

SBET soared 2,700% in just four days following the announcement, raising similar bullish expectations for Ethereum.

But on June 12, the company said investors involved in the Ether treasury deal may sell their shares. This prompted a major plunge in the stock.

Lubin said Consensys was not planning on selling its stake but the damage was done — SharpLink’s gains have evaporated.

Ethereum evangelist

In any event, Lubin appeared comfortable playing the role of Ethereum’s evangelist at DappCon in Berlin this week.

Back in 2014, he collaborated with Buterin, Gavin Wood, and other co-founders to develop the DeFi talisman.

But with the SharpLink play, he hopes to captivate a new audience.

Alongside pitching SBET analysts on Ethereum applications and DeFi on earnings calls, Lubin expects mainstream news networks will come calling soon, too.

But that’s where the comparison to the Strategy chairman ends.

When I asked Lubin whether he wants to be the Michael Saylor of Ethereum, he pushed back.

“I’ll be the Joe Lubin of Ethereum.”