Absolutely not.

This was essentially the reaction from Monero’s community after IOTA co-founder Sergey Ivancheglo declared that his Qubic mining pool was aiming to capture more than half of the privacy coin’s mining power.

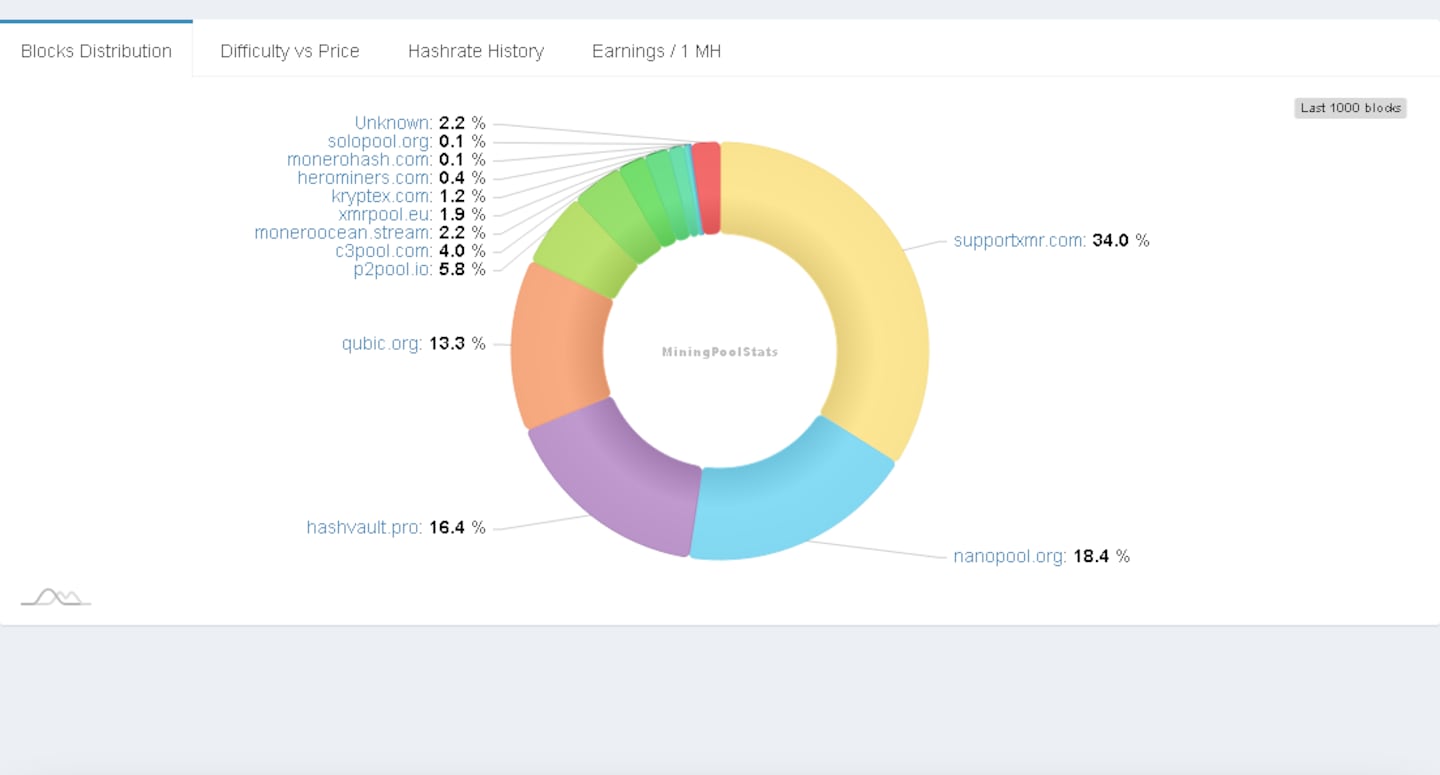

The Monero community banded together to halt Qubic’s takeover in July after it grabbed up to 40% control of the decentralised mining matrix, up from just 2% in May.

Qubic’s hashrate is under 14% as of reporting time.

But Dadybayo warned that unless the blockchain’s community makes some structural changes, then “this can happen again.”

Qubic’s failed takeover underscores how so-called 51% hashrate attacks remain a threat against decentralised finance projects.

Publicity stunt

As for why Qubic would even attempt the hash grab gambit, some respondents say the entire affair was a publicity stunt.

The Qubic token surged more than 70% in the last two weeks, while Monero is down 5% within the same period.

Seth said Qubic’s business model relies on selling the Monero coins that it mines, which means a harmful attack on the blockchain would not be in its best interests.

Ivancheglo said the move wasn’t malicious and that the team was trying to showcase its capabilities while also spreading awareness of the risks of a 51% hashrate takeover.

“This is very important because one day we may all face a non-benevolent attack,” Ivancheglo wrote on X.

51% attack

Malicious actors that launch 51% hashrate attacks often do so to extract value from a blockchain network.

By controlling more than half of a blockchain’s hashpower, bad actors can reorder transactions to double-spend cryptocurrencies.

Blockchains like Firo, Ethereum Classic, and Bitcoin Gold have suffered such attacks in the past, with millions syphoned.

And Dadybayo says Monero shares a common risk factor with those blockchains: a weak security budget.

Dadybayo reckons Monero’s security budget is just weak enough to encourage hash grab attempts.

But some analysts don’t see Qubic as a threat in that regard.

Seth said he had “extreme doubts” that a 51% attack by Qubic could even materialise and that the goal is to reduce trust in Monero.

But such soft attacks can also be devastating, according to Dadybayo.

Even if a double-spend attack doesn’t occur, real users can lose confidence in the blockchain, Dadybayo argued, while adding that a reputational collapse is just as bad as a technical one.