Robinhood to Expand Tokenized Stocks for Private Companies

Platform Doubles Down on Providing Retail Access via Ethereum Layer-2 Network amid Regulatory Challenges

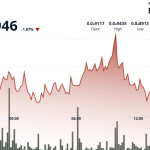

Robinhood is doubling down on its tokenized stock offerings, expanding its plan to list “thousands” of private companies on its platform via EU-compliant tokenization on its Ethereum layer-2 network, according to CEO Vladimir Tenev.

Immediate Responses and Controversy

- OpenAI publicly denounced Robinhood’s tokenization of its shares despite the company stemming only from a giveaway event.

- The platform faced accusations for improperly handling its equity, citing lack of involvement and unauthorized transfers.

The ongoing controversy stems from the controversial offer of tokenized OpenAI and SpaceX stock to select users through a limited giveaway. While these specific tokenized stocks may not yet be tradable, OpenAI explicitly stated:

“We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfer of OpenAI equity requires our approval—we did not approve any transfer.”

Expanding Access to Private Markets

Tenev emphasized the core goal of democratizing access to previously closed-off private company shares:

“We’d like to have thousands of private companies on the platform, accessible to retail. Since our announcement, I’ve had a deluge of inquiries from private companies that actually want access to retail, to have their shares tokenized…”

He highlighted the strong demand for this service, particularly within markets requiring strict regulatory compliance, asserting the platform’s 51.6% likelihood of adding more private companies by month’s end.

“Tokenized stocks are the biggest innovation in a decade!” Tenev reportedly declared, stressing the inherent value proposition for retail investors seeking exposure to real-world assets (RWA).

Technical Mechanism and Regulatory Context

Rather than relying solely on centralized reserves, Robinhood utilizes tokenization mechanisms often backed by exposure held by traditional financial partners or the platform securing specific assets. Tenev explained:

“The mechanism slightly differs depending on the asset… but the intent is for the tokens to be backed by exposure to the underlying asset, in pretty much all cases.”

The offering operates within the European Union’s regulatory framework for derivative crypto assets, positioning Robinhood’s strategy as compliantly pioneering. Tenev confirmed ongoing regulatory discussions but expressed confidence the approach “withstand[s] the highest form of scrutiny.”

While currently limited to the EU market, Tenev believes wider accessibility is imminent, suggesting the U.S. regulatory landscape “shouldn’t be too far behind” following apparent SEC discussions.