CoreWeave to Acquire Core Scientific in $9 Billion AI Data Center Deal

AI hyperscaler CoreWeave announced Monday it plans to acquire data center provider and Bitcoin miner Core Scientific in an all-stock transaction valued at approximately $9 billion, potentially wrapping up the deal by year-end.

Transaction Details and Strategic Benefits

According to the agreement, CoreWeave shareholders will receive 0.1235 shares of CoreWeave common stock for each share of Core Scientific stock. The deal is projected to grant CoreWeave access to Core Scientific’s national data center infrastructure, providing 1.3 GW of gross power capacity, with the potential for incremental capacity.

Intrator emphasized that the acquisition would “significantly enhance operating efficiency and de-risk our future expansion,” solidifying CoreWeave’s growth strategy within the competitive AI infrastructure market.

Core Scientific Perspective

Core Scientific President and CEO Adam Sullivan described the synergistic value proposition, focusing on creating superior AI infrastructure while maximizing shareholder benefits.

The deal is expected to eliminate over $10 billion in projected lease expenses over the subsequent 12 years for CoreWeave, resulting in immediate financial operational improvements.

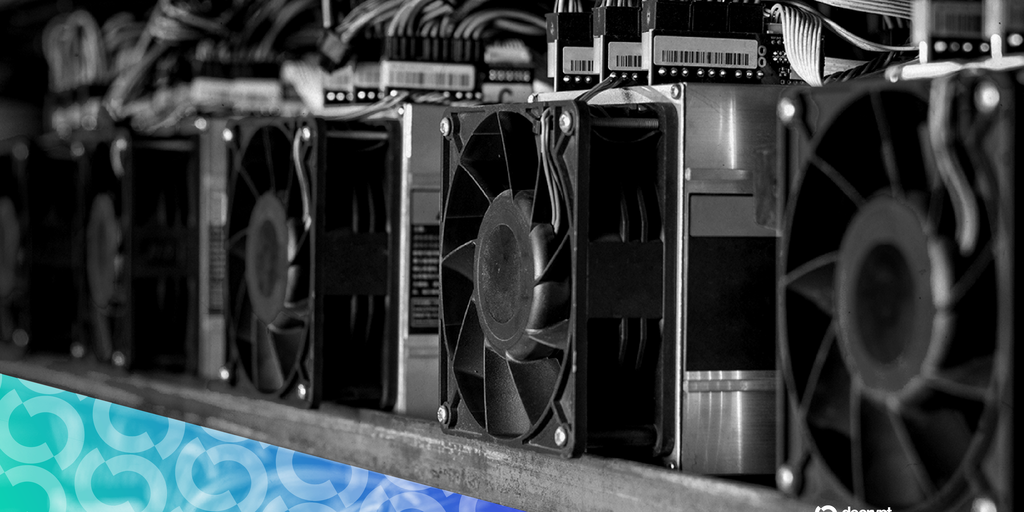

Industry Overlap and Context

This acquisition highlights ongoing industry convergence between Bitcoin mining and AI infrastructure, both of which are characterized by substantial energy demands and strategic efforts to optimize power sourcing.

Market Reaction and Timeline

Following the announcement, Core Scientific stock experienced a 17% decline, closing near $15, while CoreWeave shares dipped 3.3% during the same trading period.

The terms of the agreement anticipate completion during the fourth quarter of 2023. The Wall Street Journal initially reported potential talks between the companies in late June.