Tariff escalation, dollar volatility predict summer market jitters

Following the implementation of the “Big Beautiful Bill,” the preliminary phase of intense tariff discussions has resumed.

The Active duty rate remains fluid, subject to frequent revision. Projections suggest an effective import duty levied on actual containers stands around 21%—a significant reduction from the peak level of approximately 54% earlier.

The discrepancy between reported duties and the net collected amount stems from the tax levies currently being collected at a rate roughly equal to half the assessed rate, owing to implementation lags.

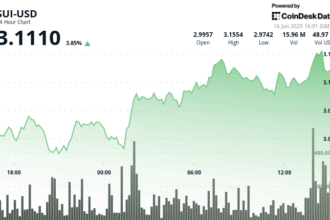

Turning to the broader economic tapestry, the dollar has experienced its most substantial markdown in the first half of the year, down 10.7% YTD.

As part of the ongoing adjustment – indeed, the near universal expectation – the proposed 300 basis points worth of decreases from the Fed are revving anticipation ranks, from which market participants derive the inescapable conclusion: dollar destigmatization is consistent with this outcome.

Recent Commitments report reveals positioning levels on the dollar are the most negative recorded in years, fueling the anticipation and confirming that this deflationary thesis is widely embraced.

Furthermore, the upcoming Federal Reserve Chair selection promises to be pivotal for the dollar. Considering the promptness with drawing down the anticipated significant yield declines thereon, observers are prepping potential further weakness.

Summer is often the backdrop for intensified volatility; seasoned market participants anticipate this narrative turning point.