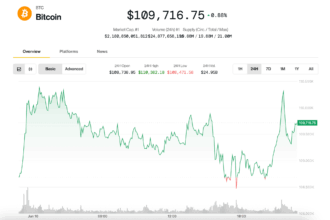

Digital assets entrepreneur Anthony Pompliano is preparing to make a major investment in Bitcoin by raising $750 million through a public investment vehicle called ProCapBTC.

ProCapBTC will acquire Bitcoin to make the digital asset more accessible to institutional and traditional investors.

Financial Times reports, Pompliano will serve as CEO of ProCapBTC, a Bitcoin-focused entity created through a merger with SPAC Columbus Circle Capital 1.

The SPAC, backed by publicly traded investment bank Cohen & Company, aims to raise $500 million in equity and $250 million in convertible debt. Upon completion, ProCapBTC could become one of the largest corporate holders of Bitcoin, potentially ranking among the top 10 holders.

Unlike typical funds with Bitcoin exposure, ProCapBTC will be an entity “centered around” the asset.

The deal is finalized pending negotiations, with potential announcement in the coming week. If successful, ProCapBTC will merge with Columbus Circle Capital 1, obtaining public market access and capacity to raise additional capital for Bitcoin purchases.

Columbus Circle Capital 1 completed a $250 million IPO in May and was formed to acquire or merge with high-growth companies, with sponsorship from Cohen & Company Capital Markets.

Cohen & Company has increased its involvement in the Bitcoin sector, providing advisory, tax, and audit services to digital asset companies, thereby lending credibility to the ProCapBTC initiative.

Anthony Pompliano, widely known as “Pomp” in crypto circles, is a prominent Bitcoin advocate, investor, and podcast host. He co-founded Morgan Creek Digital Assets and leads Pomp Investments.

This venture represents Pompliano’s second SPAC initiative, following a fintech-focused ProCap Acquisition that raised $250 million in April.

Pompliano has long advocated for Bitcoin inclusion in government and corporate strategic reserves, believing the asset will continue rising amid concerns over fiat currency debasement.

With ProCapBTC, Pompliano is executing his Bitcoin advocacy through a large-scale public investment vehicle.

The initiative emerges amid renewed Bitcoin interest, following announcements from governments and corporations establishing Bitcoin reserves. President Donald Trump’s pro-Bitcoin stance has encouraged greater participation in the digital asset space.

ProCapBTC offers institutional investors an alternative path to Bitcoin exposure without direct ownership of the digital asset.