Good Morning, Asia. Here’s what’s making news in the markets:

Bitcoin is trading below $110,000, changing hands at $109.7K, as Asia continues its trading week.

The move challenges a prevailing market narrative of summer stagnation, coming on the heels of a note from QCP Capital that emphasized suppressed volatility and a lack of immediate catalysts.

A recent Telegram note from QCP pointed to one-year lows in implied volatility and a pattern of subdued price action, noting that BTC had been “stuck in a tight range” as summer approaches.

A clean break below $100K or above $110K, they wrote, would be needed to “reawaken broader market interest.”

Even so, QCP warned that recent macro developments had failed to spark directional conviction.

“Even as US equities rallied and gold sold off in the wake of Friday’s stronger-than-expected jobs report, BTC remained conspicuously unmoved, caught in the cross-currents without a clear macro anchor,” the note said. “Without a compelling narrative to spark the next leg higher, signs of fatigue are emerging. Perpetual open interest is softening, and spot BTC ETF inflows have started to taper.”

That context makes the current move all the more surprising.

The breakout coincides with a tense macro backdrop: US-China trade talks in London and a $22 billion U.S. Treasury bond auction later this week have injected uncertainty into global markets. While these events could drive fresh volatility, QCP cautioned that recent headlines have mostly led to “knee-jerk reactions” that quickly fade.

The question now is whether BTC’s move above $110K has true staying power, or whether the rally is running ahead of the fundamentals.

A ‘Massive Shift’ in Institutional Staking May Drive ETH’s Next Rally

Ethereum’s critics have long highlighted centralization risks, but that narrative is fading as institutional adoption accelerates, infrastructure matures, and recent protocol upgrades directly address past limitations.

There’s currently $492 million worth of ETH staked by Liquid Collective – a protocol co-founded by Alluvial to facilitate institutional staking

While this figure may appear modest compared to Ethereum’s total staked volume of around $93 billion, what’s interesting is that it originates predominantly from institutional investors.

“We’re really on the cusp of a truly massive shift for Ethereum, driven by regulatory momentum and the ability to unlock the advantages of secure staking,” she noted.

Central to Ethereum’s institutional readiness is the recent Pectra upgrade, a significant development Schmiedt describes as both “massive” and “underappreciated.”

“I think Pectra has been a massive upgrade. I actually think it’s been underappreciated, just in terms of the tremendous amount of change it introduces into the staking mechanics,” Schmiedt said.

Additionally, Execution Layer triggerable withdrawals—a key component of Pectra—provide institutional participants, including ETF issuers, a crucial compatibility upgrade.

This feature enables partial validator exits directly from Ethereum’s execution layer, aligning with institutional operational requirements such as T+1 redemption timelines.

“EL triggerable withdrawals create a much more effective path to exit for large-scale market participants,” Schmiedt added.

Ultimately, Schmiedt said, “I think we’ll see that a lot more [ETH] in institutional portfolios going forward.”

News Roundup

Trump Media May Be the Cheapest Bitcoin Play Among Public Stocks, NYDIG Says

As a growing number of companies adopt MicroStrategy’s strategy of stacking BTC on their balance sheets, analysts are rethinking how to value these so-called bitcoin treasury firms.

While the commonly used modified net asset value (mNAV) metric suggests that investors are paying a premium for BTC exposure, NYDIG’s Greg Cipolaro argues mNAV alone is “woefully deficient.” Instead, he points to the equity premium to NAV, which factors in debt, cash, and enterprise value, as a more accurate gauge.

By that measure, Trump Media and Semler Scientific (SMLR) rank as the most undervalued of eight companies analyzed, trading at equity premiums of -16% and -10% respectively, despite both showing mNAVs above 1.1. In other words, their shares are worth less than the value of the bitcoin they hold.

That’s in stark contrast to MicroStrategy (MSTR), which rose nearly 5% Monday as bitcoin crossed $110,000, while DJT and SMLR remained mostly flat—making them potentially overlooked vehicles for BTC exposure.

Circle Stock Nearly Quadruples Post-IPO as Bitwise and ProShares File Competing ETFs

ProShares is aiming for a leveraged product that delivers 2x the daily performance of CRCL. At the same time, Bitwise plans a covered call fund that generates income by selling options against held shares, two very different ways to capitalize on the stock’s explosive rise.

CRCL surged another 9% Monday in volatile trading, continuing to draw interest from both traditional finance and crypto investors. The proposed ETFs have an effective date of August 20, pending SEC approval. If approved, they would further blur the lines between crypto and conventional finance, giving investors new tools to play one of the hottest post-IPO names of the year.

Market Movements:

- BTC: Bitcoin is trading at $109,795 after a 3.26% breakout fueled by institutional buying, elevated volume, and macro uncertainty from US-China trade talks and an upcoming $22B Treasury auction.

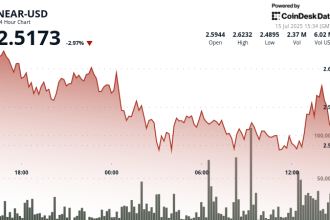

- ETH: Ethereum rebounded 4.46% from a low of $2,480 to close at $2,581, with strong buying volume confirming support at $2,580 and setting up a potential breakout above $2,590.

- Gold: Gold is trading at $3,314.45, edging up 0.08% as investors watch US-China trade talks in London and a subdued dollar keeps prices attractive.

- Nikkei 225: Asia-Pacific markets rose Tuesday, with Japan’s Nikkei 225 up 0.51%, as investors awaited updates from ongoing U.S.-China trade talks.

- S&P 500: The S&P 500 closed slightly higher Monday, boosted by Amazon and Alphabet, as investors monitored U.S.-China trade talks.

Elsewhere in Crypto

- Plasma’s XPL Token Sale Attracts $500M as Investors Chase Stablecoin Plays (CoinDesk)

- Coinbase says it’s reduced account lockouts by 82% (Blockworks)

- Argentine President Milei Exonerated in Libra Meme Coin Probe (Decrypt)