Good Morning, Asia. Here’s what’s making news in the markets:

As Asia opens the trading week,

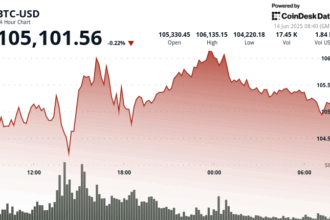

is changing hands at around $ 105,000, stuck in this range due to market uncertainty about whether the Israel-Iran conflict will escalate into a broader regional war, according to a recent note from trading firm QCP.

QCP wrote in a Friday note published on Telegram that risk reversals have “flipped decisively,” with front-end BTC puts now commanding premiums of up to 5 volatility points over equivalent calls, a clear indicator of heightened investor anxiety and increased hedging against downside risks.

The firm said that despite this defensive shift in positioning, BTC has demonstrated notable resilience. Even amid recent volatility, which saw over $1 billion in long positions liquidated across major crypto assets, on-chain data shows that institutional buying continues to provide meaningful support.

QCP emphasizes that markets remain “stuck in a bind,” awaiting clarity on geopolitical outcomes, and warns that the digital asset complex will likely remain tightly linked to headline-driven sentiment shifts for the foreseeable future.

With all that in mind, however, Glassnode data provides some reassurance to investors concerned about longer-term directionality.

Although recent volatility underscores short-term anxiety, bitcoin’s current cycle gain of 656%, while lower than previous bull markets, is notably impressive given its significantly larger market capitalization today.

Previous cycles returned 1076% (2015–2018) and 1007% (2018–2022), suggesting investor demand is still pacing closely with BTC’s maturation, even as near-term macro jitters dominate market sentiment.

Galaxy Research Says OP_Return Debate Wasn’t That Important

The OP_Return debate was less important than what a “loud but small group of critics” wanted everyone to think, Galaxy Research’s Alex Thorn wrote in a recent note.

Thorn described critics’ reactions as “wild accusations of the ‘death of Bitcoin'” and argued that such hyperbole was misplaced given historically low mempool congestion.

On-chain data shows that the mempool is virtually empty compared to a year ago, and the notion that a congested blockchain is suffocating BTC, as was the prevailing narrative in 2023, now appears significantly overstated.

In the note, Thorn further highlighted the irony of labeling arbitrary data as “spam,” reminding observers that Bitcoin’s creator, Satoshi Nakamoto, famously included arbitrary text, the “chancellor on brink of second bailout” headline, in the Bitcoin’s blockchain’s very first block.

Instead, Thorn argued, Bitcoin’s community attention would be better focused on potential upgrades like CheckTemplateVerify (CTV), a proposed opcode enabling strict spending conditions (“covenants”).

“We continue to believe [CTV] is a conservative but powerful opcode that would greatly enhance the ability to build better, safer methods of custody,” he wrote, noting that around 20% of Bitcoin’s hashrate already signaled support for the upgrade.

Bitcoin upgrades require extensive consensus-building, reflecting its open-source ethos, and Thorn emphasized that cautious, deliberate evolution remains critical for broader adoption and scalability.

ByBit Launches Byreal, a Solana-Native Decentralized Exchange

Bybit is entering the decentralized exchange space with Byreal, an on-chain trading platform built on Solana, Ben Zhou, Bybit’s CEO announced via X over the weekend.

Announcing Byreal — our first onchain DEX incubated by Bybit, will be LIVE by end of the month. Starting from scratch and now born on Solana. what’s special: 1/ CEX + DEX synergy Byreal isn’t “just another DEX.” It’s combining CEX-grade liquidity with DeFi-native transparency.… https://t.co/JU60e4zHQ4

— Ben Zhou (@benbybit) June 15, 2025

Byreal’s testnet is scheduled to launch on June 30, with the mainnet rollout expected later this year. Zhou said that Byreal is designed to combine centralized exchange features such as high liquidity and fast execution with the transparency and composability of DeFi. The platform will also include a fair launchpad system and curated yield vaults linked to Solana-native assets like bbSOL.

Market Movements:

- BTC: Bitcoin held near $105,000 after more than $1 billion in leveraged positions were liquidated, led by a $200 million long on Binance, as rising Israel-Iran tensions triggered a sharp selloff, a flight from altcoins, and a brief but intense bout of volatility.

- ETH: Ethereum rose 2% to around $2,550 after finding strong support at $2,510, showing resilience amid Israel-Iran tensions and broader market volatility, with continued institutional inflows supporting the uptrend.

- Nikkei 225: Asia-Pacific markets rose Monday, led by Japan’s Nikkei 225 gaining 0.87 percent, as investors weighed escalating Israel-Iran tensions, while oil and gold prices surged on safe haven demand.

- Gold: Gold climbed to $3,447 in early Asian trading Monday, hitting a one-month high as Middle East tensions and rising expectations of a September Fed rate cut outweighed strong U.S. consumer sentiment data.

Elsewhere in Crypto:

- Chart of the Week: Bitcoin’s Summer Lull Still Offers ‘Inexpensive’ Trading Opportunity (CoinDesk)

- Trump Strategist Outlines How Bitcoin Helped Republicans Win the 2024 Election (Decrypt)

- Will the Cardano Foundation Buy BTC? (CoinDesk)