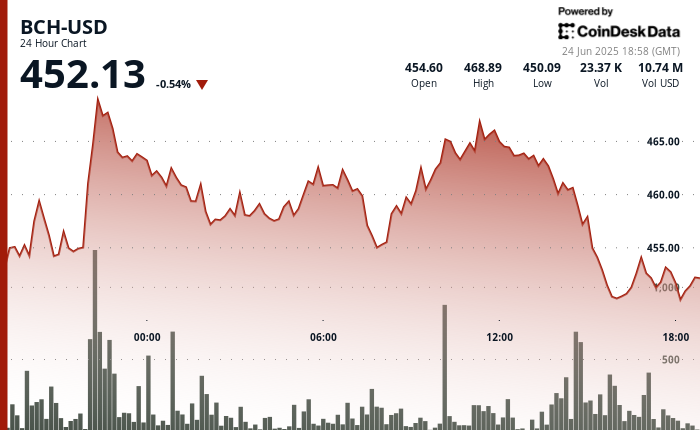

Bitcoin Cash (BCH)

is trading at $452.13, down 0.54% over the past 24 hours, after failing to breach the $467 resistance level across multiple tests, according to CoinDesk Research’s technical analysis model.

The token briefly surged near that level late on June 23, gaining nearly 3% during a high-volume spike, but was subsequently rejected twice more, reinforcing the significance of that barrier. A descending trendline formed during the corrective pullback, with lower highs establishing a bearish short-term tone.

On the regulatory front, Federal Reserve Chair Jerome Powell announced that U.S. banks now have the freedom to determine their digital asset customer base without prior regulatory pre-approval. This policy shift effectively removes institutional adoption barriers and is considered a meaningful step toward greater integration of crypto within the traditional financial system.

Technical Analysis Highlights

- BCH traded in a $19.76 range (4.4%) from $449.61 to $469.63 over 24 hours.

- At 22:00 on June 23, BCH surged nearly 3% on 79,485 volume units, setting resistance at $467.

- The $467 level was tested and rejected two more times, confirming strong overhead resistance.

- Support formed around $450 with significant volume accumulation between 15:00–16:00.

- A descending trendline of lower highs emerged following the initial spike, signaling bearish momentum.

- A V-shaped micro-trend formed during the final hour, with a bounce from $449.94 to $451.31.

- Volume spiked during the 18:17–18:19 drop and again on the 18:30–18:32 recovery.

- A short-term support zone developed near $450 after repeated successful retests.