More than $680 million in crypto positions were liquidated over the past 24 hours with short traders taking the bulk of the pain as a bitcoin

breakout above $121,000 triggered a chain reaction across derivatives markets.

Roughly $426 million of the total liquidations came from bearish bets, according to Coinglass data, making it one of the largest weekend liquidation events in recent months. The largest single order, a $92.5 million BTC short, was flushed on HTX.

BTC alone saw $291 million in forced closures, with futures tracking ether (ETH) and XRP

following at $68 million and $17 million, respectively. XLM (XLM) and pepecoin (PEPE) also posted elevated activity, signaling that the squeeze extended deep beyond major tokens.

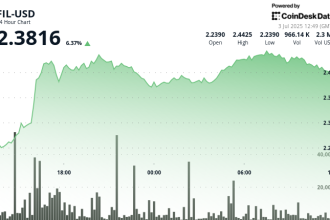

Meanwhile, dogecoin

, Solana’s SOL (SOL), and SUI

saw rising open interest, though with relatively smaller drawdowns, indicative of higher spot-based demand.

Liquidations occur when traders using leverage are forced to close their positions due to margin calls. While they often signal excessive positioning, they also serve as a reset mechanism for markets, flushing weak hands and clearing the way for new directional flow.

Bitcoin’s rally in the past week has sparked a broader breakout across major crypto assets. Traders say that market structure is evolving under the weight of institutional influence — with eyes on the $130,000 mark in the short term.