Bitcoin Stabilizes Amid Profit-Taking as Long-Term Holders Cash Gains

This article is for informational purposes only. Every investment and trading move involves risk, and readers should conduct their own research.

Key Takeaways:

- Bitcoin is trading in a $100,000–$110,000 range as mid-to-long-term holders (LTHs) engage in profit-taking.

- Despite significant profit-taking from various holding periods, analysts suggest the market is absorbing selling pressure.

- Historical data points towards potential price strength, including a traditionally strong month for Bitcoin in July.

Price Consolidation Amid Profit-Taking

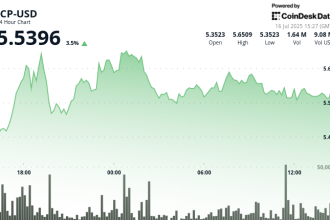

Bitcoin is currently trading within a range of approximately $100,000 to $110,000, according to data from analytics provider Glassnode.

This consolidation follows a sustained sell-off by mid to long-term holders (LTHs), who are locking in profits. Data shows coins aged 3–5 years contributed $849 million in daily realized profit, with 7–10 year holding period coins realizing $485 million and the 1–2 year cohort realizing $445 million.

Daily realized profits peaked recently at $2.46 billion, though the 7-day average sits at $1.52 billion, slightly below the $4–5 billion peaks seen late last year.

Interpreting the Profit-Taking

CryptoQuant analyst Yonsei Dent views escalating profit-taking activity by LTHs as potentially net positive. Dent explained that the consistent appearance of older coin movement signals strength within a bull market cycle.

“Despite the selling pressure,” Dent stated, “BTC’s price has remained stable, meaning the market is absorbing it due to steady demand. More activity from coins held for 1–3 years reflects profit-taking from previous cycle holders, signaling a positive transition of market leadership from older to newer participants.

Historical Context and Outlook: A Positive Trajectory?

Bitcoin’s historical performance in July offers a potential catalyst for upside. Since 2013, the cryptocurrency has averaged a 7.56% return this month, achieving gains in eight of twelve periods, with a 24.03% surge recorded in 2020.

Technical analysts also point to broader market signals. CryptoCon highlights the potential alignment of Bitcoin with the S&P 500, noting Q3’s tendency for robust risk-asset returns. CryptoCon’s analysis identifies a long “Cycle 4 Ranges Expansion” phase.

Looking back since 2023, Bitcoin’s breakouts have consistently occurred over 30–40 day windows, followed by consolidation. If this pattern repeats, the next breakout could target the $140,000–$150,000 range.

This article does not contain investment advice or recommendations.