Bullish Indicators Point to $110K BTC Breakout and New All-Time Highs Possible

Updated: July 1, 2025

Key Takeaways

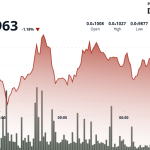

- Bitcoin’s price is approaching a significant technical level near $110,000.

- Rising indicators, led by compressed Bollinger Bands, hint at potential bullish momentum and a potential all-time high target.

- Multiple market factors contribute to the bullish case.

Bollinger Bands Signal Potential Breakout

Technical analysts point to the compression of the Bollinger Bands indicator below $110,000 as a bullish signal potential. The indicator showed its tightest spread since February 2024.

Crypto analysts including Crypto Rover, Cantonese Cat, and Frank Fetter have weighed in, describing the bands as significantly compressed, signifying an upcoming “bigger move” or upward breakout.

Historical precedent drawn from previous Bitcoin rejections near upper Bollinger Bands suggests a similar focus around the current $108,900 price.

Originator John Bollinger joined the chorus, stating, Bitcoin looks to be setting up for an upside breakout.

Factors Fueling Bullish Outlook

Maintaining bullish momentum despite price consolidation near resistance, analysts cite several drivers:

- Continued institutional demand through Bitcoin spot ETFs.

- Recognition of numerous tailwinds reinforcing the bullish thesis, including regulatory developments and upcoming events.

- A higher timeframe “cup-and-handle” chart pattern pointing towards a potential $230,000 breakout.

- Looser “Crypto Week” legislation anticipated this month, potentially impacting investor risk appetite.

On-Chain MVRV Ratio Supports Current Uptrend

Data provider CryptoQuant indicates the Bitcoin Market Value Realized (MVRV) ratio is currently 2.23, above its 365-day simple moving average of 2.15.

CryptoQuant analyst Burakkesmeci notes that historically, an MVRV exceeding its SMA365 signals the bull trend is intact, adding evidence to the current market conditions being supportive for higher prices.

Broader Macro Cues and Catalysts

Broader economic factors, including increases in global money supply (M2), are also viewed by some analysts as potential catalysts for further price appreciation in the coming months.

Investment Disclaimer

Investment and trading in cryptocurrencies involve significant risk. This article is not investment advice. Readers should conduct their own research before making any investment decisions.