Market Overview

The ceasefire between Israel and Iran appears to have been factored into trader sentiment, cooling markets after significant gains earlier in the week. While two coins rose more than 10%, the top 100 coins by market cap saw an average daily price increase of around 2%. The total cryptocurrency market cap is now $3.283 trillion, marking a modest 0.81% increase.

Meanwhile, traditional markets remained stable. The S&P 500 closed slightly higher at 6,097 points (0.07% gain). The Federal Reserve maintained interest rates in the 4.25%-4.5% range, creating a cautious environment. Fed Chair Jerome Powell stated the central bank is “well positioned to wait” for clearer economic direction. Prediction data from Myriad, developed by Decrypt’s parent company Dastan, currently suggests the Nasdaq is expected to outperform the S&P 500 in June.

Bitcoin Cash (BCH): Strong Rally

Bitcoin Cash surged approximately 6% intraday, reaching $481.30, breaching the critical $470 resistance level. This breakout was accompanied by significant volume and bullish technical indicators.

The 61 reading on the Relative Strength Index (RSI) indicates strong momentum without entering overbought territory. The Average Directional Index (ADX) at 20 signals a developing trend. BCH is trading well above both its 50-day and 200-day exponential moving averages ($385 and $352 respectively), suggesting strong upward momentum. The technical Squeeze Momentum Indicator indicates an “ON” status with upward trajectory, suggesting rising price volatility.

Key levels to monitor are $460-$470 (support), $385 (50-day EMA support), $500 (psychological resistance), and $540 (stronger resistance).

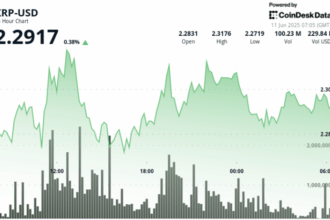

Cardano (ADA): Technical Weakness Persists

Cardano experienced a sharp 3.5% drop over the last 24 hours, hitting $0.5669. This move followed an announcement by Cardano founder Charles Hoskinson regarding treasury actions, whose market reception remains ambiguous.

Technical indicators align with bearish sentiment. The RSI dipped to 35, nearing oversold territory. The ADX reading of 26 confirmed a strong bearish trend. ADA is trading below both its 50-day and 200-day EMAs, reinforcing the downtrend. The Squeeze Momentum Indicator shows an “OFF” status with negative momentum.

Key levels are $0.5500 (support), $0.5000 (major support), $0.5900 (resistance), and $0.6400 (stronger resistance, near the 50-day EMA).