Bitcoin Nears $119,000 as Analysts Predict Parabolic Rally

- Bitcoin’s price has surged, breaching its long-term “power law” curve, mirroring patterns preceding euphoric price peaks.

- Weakening US Dollar and anticipated Federal Reserve rate cuts are posited as catalysts for a broad risk-on market rally, potentially benefiting Bitcoin significantly.

- Spot Bitcoin ETFs have absorbed a majority (70%) of gold’s year-to-date inflows, highlighting institutional shifts towards crypto.

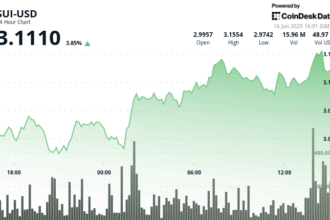

Bitcoin (BTC) price climbed approximately 10% in July, touching new record highs around $118,600. This ascent has sparked predictions from anonymous analysts, who suggest the trajectory could herald a substantial upward push.

Anonymous Bitcoin analyst apsk32 contends Bitcoin is ahead of its long-term power law curve, a mathematical model depicting its historical exponential climb. Departing from standard dollar valuation, this analysis, termed Power Law Time Contours, measures price divergence based on time units. Currently, Bitcoin is slightly more than two years ahead of this fundamental trendline.

apsk32 explained that Bitcoin currently registers at slightly over 79% of its “extreme greed” historical data under this methodology. This zone, previously associated with blow-off tops occurring roughly every four years, spans roughly from $112,000 to a potential peak as high as $258,000.

Analysts anticipate a potential reversal of momentum towards the year-end if prevailing trends continue. apsk32 implied that adherence to the four-year pattern could position Bitcoin between $200,000 and $300,000 by year’s end. A subsequent bearish phase was forecast to initiate around early 2026.

Adding weight to potential near-term upside, CEO of perpetual trading platform Rails, Satraj Bambra identified macroeconomic conditions favorable for Bitcoin. He highlighted a potential expansion of the Federal Reserve balance sheet and the prospect of lower interest rates – potentially influenced by new leadership addressing economic headwinds, such as those from rising tariffs – as powerful catalysts.

Bambra emphasized the US Dollar Index (DXY) dipping below 100 as a significant early signal of incoming lower rates and ensuing stimulus. He stated:

“I see Bitcoin going parabolic in the region of $300K–500K driven by two key forces.”

Bitcoin ETFs Challenge Gold’s Position in Risk-On Flows

Data indicates U.S. Spot Bitcoin ETFs captured a commanding 70% share of gold’s year-to-date net inflows, signaling robust late-stage interest in Bitcoin as a secure asset class.

Bitcoin continues to exhibit characteristics as a “risk-on” asset, displaying moderate correlation with the Nasdaq 100, consistent with longer-term averages. Its performance independence from traditional safe havens like gold and bonds is noted as a distinct portfolio diversification attribute.

Further reinforcing Bitcoin’s bullish narrative, Fidelity’s Director of Global Macro, Jurrien Timmer, described the market sentiment shifting back towards Bitcoin. He attributes this, in part, to improved risk-adjusted returns indicated by the convergence of Sharpe ratios between Bitcoin and gold. These metrics show returns adjusted for volatility relative to a risk-free rate.

The analysis cited a chart showing returns (often inversely correlated with volatility) have definitively shifted: Gold yields approx 4x, Bitcoin yields 1x, though Timmer noted this needs context regarding absolute risk levels. The interpretation is that Bitcoin’s perceived risk-reward profile has potentially improved relatively.

The crypto market’s performance is also sparking ripple effects. In a recently published analysis, Ethereum has seen increased interest – $ETH$ $120K $Bitcoin $expectations – linked to the ongoing Bitcoin market enthusiasm.