Bitcoin Price Dips Following Large Whale Withdrawal

In reaction to news concerning a single, exceptionally large holder (“whale”) moving dormant Bitcoin holdings following a 14-year hiatus, the cryptocurrency experienced sharp selling pressure on Tuesday.

In Brief

- A total of 80,000 BTC, valued at approximately $8.6 billion at the time, was withdrawn from wallets presumed to belong to the same entity that possessed Bitcoin since early 2011.

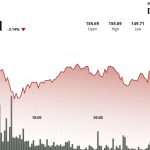

- Bitcoin’s price dropped from above $109,000 to near $107,500 following the news.

- Despite the short-term price decline, long-term indicators and the broader market context suggest the overall bull market remains intact.

The entity responsible for the transaction remains anonymous, though its wallet holdings align with previous large Bitcoin acquisitions dating back to the cryptocurrency’s earliest days (April/May 2011 when the price was between $0.78 and $3.37). This amount, potentially exceeding 200,000 BTC acquired in 2011 (worth ~$22 billion today), places the holder among the top five by total Bitcoin ownership ever recorded.

The withdrawal, occurring on a U.S. holiday weekend, has fueled concerns within crypto communities. Speculation revolves around the identity of the entity, a potential market-moving event (“Pump and Dump”), or even the results of early exchange or mining operations.

For short-term traders, the news appears to be validation of taking profits after a prior 15% rally within about 60 days, leading to a “sell the news” reaction. While immediate technical resistance near the $110,000 mark caps upside momentum, traders point to several strong bullish indicators, including the robust price position relative to significant moving averages (especially the 200-day EMA) and technical oscillators reading within neutral-to-bullish territory (RSI @62, ADX @25).

Key support levels are seen near $105,000 and $100,000, while resistance targets are pegged at $110,000 and the significant $115,000 psychological barrier.

Analysis suggests the current price pullback provides an opportunity for consolidation while the stronger position trader and long-term investor remains bullish, reinforcing the thesis that this extends the ongoing bull market phase.