Okay, here is the rewritten article content formatted in a professional news style using HTML:

BTC Short Squeeze Potential as Liquidity Builds; Dominance Recovers

Bitcoin’s price dipped near $117,000 Thursday, triggering hopes for a potential short squeeze amidst accumulated buying pressure on exchange books. However, increasing short positions also put long holders on edge.

Bitcoin (BTC) found support near $117,000 on Thursday morning amid expectations of a potential cascade as participants anticipated a squeeze on large short positions.

Accumulating Liquidity and Short Squeeze Fears

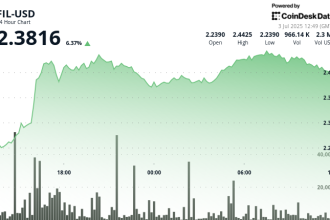

Data from Cointelegraph Markets Pro and TradingView shows BTC/USD attempted a drop to local lows of approximately $117,200 on Bitstamp, acting as a corrective measure after prior gains.

This dip dislodged some bidder interest from order books, but other market participants primarily watched sell-side orders.

CoinGlass data confirms this scenario, highlighting increased buying pressure near the spot price following Wednesday’s test below $118,000. Such accumulated overhead liquidity often influences price behaviour.

“Bitcoin liquidity is piling up on the topside,” observed Mister Crypto. “A massive short squeeze is inevitable!”

Fellow trader Crypto Rover concurred, describing the short squeeze scenario as an “obvious” next step.

Prior analysis highlighted key resistance levels. As noted by trader Daan Crypto Trades, monitoring “liquidity clusters below $115K & $120K” is crucial, expecting movement beyond these zones.

Bitcoin Commands Crypto Market Backstage

While short squeeze speculation fuels near-term narratives, Bitcoin is simultaneously demonstrating a broader reassertion of influence within the crypto ecosystem.

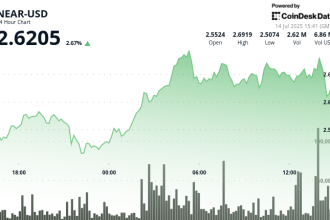

BTC dominance climbed 0.5% on Thursday, building upon an existing trend where the coin approached the 60% overall market cap benchmark. This signals a diminishing lead for other cryptocurrencies (“altcoins”).

Analyst Rekt Capital explained the market sentiment: “The Altcoin market is reacting as if Bitcoin has broken down from its Range. But it hasn’t. In fact, it’s retesting the Lower High and Range Low as support. The retest is in progress.”

Momentum shift around $118,000 had previously spurred capital inflows into promising altcoins. The recent consolidation phase at the crypto market heavyweight’s feet may signal a change in that capital rotation.

Disclaimer

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.