Digital Assets Record Unprecedented Weekly Inflows Amid Market Activity

Despite geopolitical tensions, ten consecutive weeks of inflows pushed year-to-date totals over $15 billion, according to CoinShares data.

Key Highlights

- Digital asset investment products recorded $1.24 billion in weekly inflows.

- This marks ten consecutive weeks of positive inflows.

- Year-to-date cumulative inflows reached $15.1 billion.

- Bitcoin led inflows at $1.1 billion, accounting for 88.7%.

- Ethereum continued its ninth consecutive week of positive inflows.

- U.S. markets dominated global inflows at $1.25 billion.

Main Trend Analysis

Institutional investors continued channeling capital into digital assets despite heightened geopolitical uncertainty, driving the tenth consecutive week of inflows and setting records for year-to-date totals exceeding $15 billion, according to CoinShares data released Monday. According to CoinShares senior research analyst James Butterfill, “We may see some minor panic outflows,” however, “any price weakness will lead to further adding to positions.”

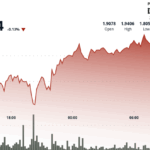

The surge in activity appeared to taper off towards week’s end as markets closed for the Juneteenth holiday and following emerging reports of U.S. involvement in the Iran conflict. As U.S. airstrikes on Iran became official news later Sunday evening, Bitcoin prices rebounded.

Asset Performance

Bitcoin dominated inflows, attracting $1.1 billion, or approximately 88.7% of total inflows, despite recent price corrections. Short-Bitcoin investment products saw minimal outflows ($1.4 million), suggesting limited bearish sentiment among sophisticated investors. This contrasts with previous cycles where geopolitical events typically prompted substantial outflows.

Ethereum maintained its ninth consecutive week of inflows, amassing $124 million and reaching cumulative inflows for the year totaling $2.2 billion. This represents Ethereum’s longest uninterrupted positive streak since mid-2021. Solana and XRP also drew inflows ($2.78 million and $2.69 million respectively), reflecting sustained investor interest in broader asset classes.

Geopolitical Influence & Regional Flows

The ongoing inflows underscore a significant shift in institutional perspectives, viewing digital assets increasingly as essential, long-term portfolio components rather than purely speculative assets.

Regional distribution showed significant divergences: U.S. markets accounted for $1.25 billion (nearly half global inflows), while Canada and Germany saw modest inflows of $20.9 million and $10.9 million. Notably, Hong Kong recorded outflows of $32.6 million.

China condemned the U.S. airstrikes, calling them an “exacerbation of regional tensions,” according to media reports. The discovery of Iran’s key nuclear facilities via satellite imagery, subsequently targeted by the airstrikes, was flagged by the U.S. administration as part of its response strategy.