Bitcoin Golden Cross Sparks Bullish Momentum Amidst Consolidation

By [Journalist Name], Published: [Date]

Key Developments

- Bitcoin confirmed a daily chart ‘golden cross’ on May 22nd, following a period of consolidation below $120,000.

- The technical indicator, signifying a potential bullish trend reversal, has historically preceded average price gains exceeding 2,000%.

- Analysts suggest a potential breakout towards $155,000 as momentum indicators suggest renewed capitulation below the key psychological zone.

Bullish Signal Confirmed

Bitcoin (BTC) has triggered a potential bullish signal following a daily chart ‘golden cross,’ where the 50-day simple moving average crossed decisively above the 200-day simple moving average.

Traders often interpret this classic technical indicator as bullish.

“Every. Single. Time. This signal shows up $BTC goes vertical,”

Historical Performance Data

Analysis reveals significant long-term gains average 2,000%+ following extended periods of the golden cross indicator.

The most recent instance of the pattern dating back to October 2024, coinciding with BTC trading around $65,000, prompted subsequent gains to nearly $110,000 within three months.

Computing potential target levels from this 2024 cross confirms $155,000, where current price-action analysis suggests a similar setup despite only 12% gains to date.

This article is not financial advice. Investing and trading involve substantial risk.

Market Structure & Price Targets

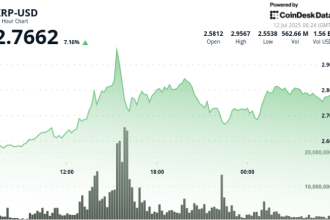

Current consolidation below the $120,000 zone is drawing investor attention ahead of potential upside targets.

“A Daily Close above ~$120k resistance would validate a break higher,” noted Rekt Capital (@RektCap) while observing capital movements into alternative cryptocurrencies during BTC’s sideways phase.

Technical analysis increasingly points towards $135,000 as the immediate psychological benchmark.