Bitcoin Endures Pronounced Pullback Amid Signs of Crypto Market Froth

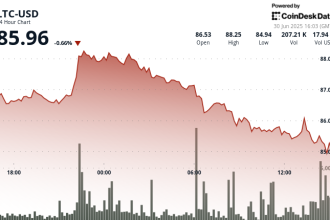

Bitcoin experienced a significant downturn, shedding more than 2% from its $120,000 daily peak on Wednesday morning during the Wall Street opening. This correction saw the cryptocurrency dispatch accumulating buy liquidity, a technical tactic interpreted by some analysts as a potential signal for subsequent price consolidation or exploration of lower support levels.

Detailed data from Cointelegraph Markets Pro and TradingView confirmed the slide, with the BTC/USD pair falling into negative territory. Initial momentum that saw it breach the $120,000 threshold faded relatively quickly, making way for sustained sell-side pressure contrary to expectations for a sustained breakout.

Liquidity Concentration and Market Signals

Data from CoinGlass highlighted heightened market structure concerns. Following the intra-day drop, the platform reported a sharp accumulation of ask liquidity near the spot price, suggesting systemic selling pressure. “The liquidity of long and short high leverage is very juicy,” CoinGlass reportedly commented earlier.

Exacerbating the bearish signals, Cointelegraph Markets Pro tracked a substantial loss in leverage positions during the preceding 24 hours. Over 176,570 traders experienced liquidation in Bitcoin trading alone, resulting in a total of $517.65 million wiped out. This figure pushed overall liquidations across cryptocurrencies towards the $1.1 billion mark, underscoring aggressive bet-hedging activity prevalent among market participants.

Analyst Perspectives: Consolidation Expected

Commenting on the overnight performance where prices briefly flirted with $120,000, famed crypto trader and analyst Michaël van de Poppe characterized it as “liquidity sweep” activity. He stressed that the upward excursion lacked staying power, suggesting it merely represented a “range test” and forecasting a high probability of retesting the significant low previously established.

Technical analysis also played a part in interpreting the correction. While some traders like Crypto Virtuos viewed the movement as a preliminary consolidation potentially aimed at recalibrating to a crucial Fibonacci support zone, anticipatory of $113,000 and ultimately a more ambitious target at $138,000 (though he remains cautiously optimistic about a rebound), others primarily focused on the immediate near-term liquidity grab.

Growing Concerns of “Froth” on Altcoins

Amidst the volatility in the largest cryptocurrency by market cap, broader market concerns intensified. On-chain analytics provider Glassnode warned about a burgeoning “froth” across the market, predominantly fueled by the concurrent altcoin boom.

In its “The Week OnChain” newsletter published Tuesday, Glassnode cautioned that “high levels of open interest (OI) … puts upside momentum at risk.” The analysis stated:

“Such conditions point to a degree of froth starting to form in the market, and may leave it more susceptible to sharp volatility.”

“Elevated leverage tends to amplify both upside and downside volatility, and can contribute to a more reflexive and fragile market environment.”

Consistent with these warnings, Glassnode data confirmed that Open Interest (OI), particularly for the top four largest altcoin market caps (Bitcoin aside), surged past the psychological $40 billion barrier, establishing a fresh all-time high. This confluence of factors—Bitcoin’s pullback juxtaposed with elevated altcoin OI and widespread leverage—has prompted serious debate about potential imbalances and the sustainability of recent gains.

This report presents market information as context and educational content. It is not intended as, nor should it be construed as, investment advice or a recommendation to engage in any investment activity. Market conditions are dynamic and investments involve inherent risks.