Could a Bitcoin Rally to $110,000 Be Brewing?

Key Considerations:

- Better-than-expected fixed income performance

- Potential inflationary pressure

- $531M Strategy cryptocurrency purchase

- SPDR Portfolio SPY ETF inclusion possibilities

Recent Bitcoin Volatility

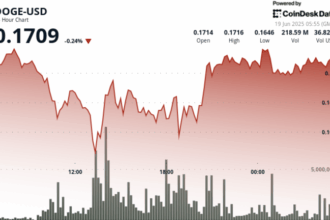

Bitcoin (BTC) has stayed within a tight trading range for over a week, featuring exceptionally low volatility with six consecutive days of swings under 3%. This compressed range has led traders to assess breakout probabilities amidst ongoing concerns about the deteriorating US fiscal position and corresponding dollar trends.

Focusing on the Dollar Dynamics

While US dollar weakening is frequently cited in crypto discussions, analysis questions its sole role as an indicator for potential Bitcoin price appreciation. While a Reuters chart confirms Bitcoin’s inverse correlation didn’t hold during certain months this year, a closer examination reveals n’t necessarily the case. Historical data shows both assets demonstrated concurrent strength over August 2024 through April 2025.

A persistent view holds that a weaker DXY benefits US-based multinational corporations whose foreign earnings translate more cheaply into dollars. However, Bitcoin’s likely global distribution creates a more complex impact compared to equity holdings listed abroad.

Beyond the Correlation

Analysts continue evaluating potential S&P 500 index additions that could cascade passive capital flow into alternative assets, though the final rule regarding potential inclusion isn’t expected for months. Market strategist Joe Burnett noted the potential for “a tsunami of passive capital” in such scenario.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.