Bitcoin Slumps Below $108K Amid Suspicious 80,000 BTC Dormancy

July 4, 2025 • 2 minutes read

Key Points

- BTC drops nearly 2% in 24 hours after 80,000 dormant coins move on-chain

- Unverified rumors link transaction to Satoshi Nakamoto creator

- Price recovery may depend on short liquidation levels near $110,000 resistance

BTC Retreats Below Key Support Level

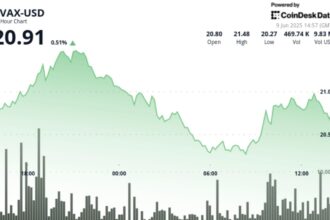

Bitcoin experienced a significant pullback on July 4, slipping below the psychologically important $108,000 mark following unusual activity involving long-dormant coins.

Rumors Swirl as Giant “OG” Coin Resurfaces

Data analysis from Lookonchain reveals an unprecedented transaction where a single entity moved 80,000 Bitcoin (worth approximately $8.69 billion at current prices) after 14 years of dormancy.

“A Bitcoin OG holding at least 80,000 BTC… woke up after 14+ years of dormancy… transferred out 40,000 BTC today!”

— Lookonchain (@lookonchain), July 4, 2025

The transfers occurred just as the U.S. market closed for the Independence Day holiday, with markets reacting nervously to the significant movement of supposedly inactive coins.

Social Media Fueled Speculation

Amid concerns about potential short-term selling pressure, social media amplified speculation with popular trader CryptoBeast even suggesting a connection to Satoshi Nakamoto.

Professional trader TheKingfisher detected unusual “toxic” order flow coinciding with the transaction, suggesting market makers faced significant losses.

Bullish Resistance Strengthening

Bullish resistance remains concentrated above $110,000, with significant short liquidation exposure building up near this level according to CoinGlass data.

Analyst Rekt Capital highlighted that the price action appeared to be breaking the key daily trendline established since reaching the all-time high near $112,000.

“Bitcoin is losing the diagonal for the moment. But if price Daily Closes above the diagonal then this will have ended as a downside wick as part of a volatile retest. Upcoming Daily Close will be pivotal.”

Market Implications

The timing of this large-scale movement has market participants divided. While some interpret this as a genuine shift of long-term holdings, others suspect liquidation pressure from large short positions.

Disclaimer: This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.