Here is the rewritten article in a professional news style, HTML formatted for clarity:

Analysts Split on Bitcoin’s 2025 Price Target Amid Market Volatility

Fundstrat co-founder and BitMine chairman Tom Lee has proposed Bitcoin could surge towards $250,000 by next year, but many crypto analysts have dialed back their ambitions amid recent market turbulence.

Lee Predicts All-Time High Closure

Speaking on Coin Stories, Lee said Bitcoin should “really build upon this 120 [percent] before the end of the year,” forecasting a range from $200,000 to over $250,000. This target, previously set for a 12-month deadline in late 2023, positions him as one of the most bullish Bitcoin forecasters.

A Mixed Bag of Analyst Forecasts

While some analysts like BitMEX founder Arthur Hayes and Unchained’s Joe Burnett share Lee’s optimistic long-term view, others have adopted a more measured stance. Key opinion pieces dropped from financial institutions such as Bernstein and Standard Chartered peg the high mark at $200,000. 10x Research’s Markus Thielen suggested an even more modest $160,000 peak.

The divergence in analysis comes with just five months left until the 2025 deadline. Lee argues this disconnect could signal the conclusion of a four-year Bitcoin cycle, driven by rising institutional adoption and shifting industry consensus.

“When there is plenty of skepticism and reasons to be skeptical, it allows markets to have positive surprise.”

However, this isn’t universal optimism. Rekt Capital suggests mimicking Bitcoin’s 2020 cycle pattern points to a potential market peak this October, 550 days post the 2024 halving. Conversely, Bitwise CIO Matt Hougan has declared the four-year halving “dead,” betting on 2026 being favorable for long-term Bitcoin investment.

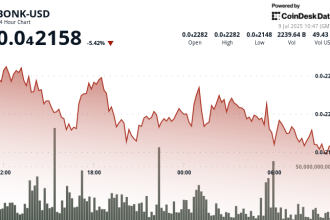

Market Volatility and Shifting Sentiment

Lee’s upbeat prediction arrives against the backdrop of recent volatility. Despite recently hitting an all-time high near $123,100, the leading cryptocurrency retreated recently. According to data provider Nansen, BTC dipped to $112,044 and held around $113,000 when the article was completed.

This movement corresponded with a cooling of crypto market sentiment indicators. The Crypto Fear & Greed Index recently retreated from a strong “Greed” reading of 60 to a “Neutral” 54.

Lee views skepticism positively, asserting that widespread public agreement in bullishness often precedes price inefficiencies and suggests further upside remains achievable.

Near-Term Focus and Further Risks

Laeightsbitcoin added that his $1 million long-term forecast is technically sound given current dynamics.

Amid these headlines, analysts caution that other cryptocurrencies may face inherent risks. Trade Secrets recently warned Ethereum holders could “rip like 2021” unless preparing for potential SOL drops.

$160K to $200K Range

Volatility & Sentiment

This analysis does not constitute investment advice or recommendations. Investing in cryptocurrencies carries significant risk, and users are advised to conduct their own thorough research before making any decisions.

%PUBLICATION MARKETS OUTLOOK: STANDARD SUBSCRIPTION FORM CODE%

This version uses standard HTML structure (<article>, headings, <figure> for media), and inline text emphasis (bold and italics). It refines the heading choices for better flow, rephrases the content for elevated structure, and incorporates the disclaimer appropriately.