Crypto analyst Markus Thielen predicts Bitcoin could reach $116,000 by month-end, attributing the potential surge to three macroeconomic factors.

Markus Thielen, Head of Research at 10x Research, told Cointelegraph that $116,000 represents a target as Bitcoin approaches the top of its current consolidation range.

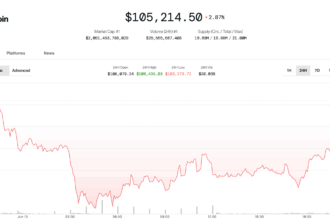

Bitcoin testing key resistance level

“Bitcoin is testing the top of its consolidation range, just as a perfect storm of macro catalysts begins to build,” Thielen reported.

Key factors identified are: i) Strong inflows into spot Bitcoin ETFs; ii) US Federal Reserve policy uncertainty (including potential political pressure); and iii) A sustained decline in Bitcoin supply on crypto exchanges, down 98 consecutive days.

A $116,000 target implies ~6.45% upside from recent lows ($108,990) and ~3.60% upside from the recent peak near $111,970.

Bullish Factor 1: Robust ETF Inflows

Despite a recent single-day outflow break after 15 consecutive inflows, sustained inflows into US spot Bitcoin ETFs are seen as a positive reinforcing factor.

“These flows are increasingly outpacing price action, signaling institutional demand driven more by macro concerns than short-term momentum.”

Thielen suggested US political rhetoric, including pressure from President Trump on Fed Chair Jerome Powell, likely stimulated these inflows.

Farside data indicates $9.91 billion in inflows to US spot ETFs since May 1 ($4.58 billion for GBTC), accounting for ~20% of their total inflows since the 2024 inception.

Potential Catalyst: Fed Policy Shift?

Thielen speculates Trump could nominate a Fed chair more inclined toward rate cuts if re-elected, although timing and Federal Reserve independence could also be factors.

“It may only be a matter of time before Trump nominates a new Fed chair more inclined toward rate cuts, evoking comparisons to Arthur Burns…”

Bullish Factor 2: Exchange Balances Declining for 98 Days

Sustained reduction of Bitcoin on exchanges represents “rising scarcity,” which Thielen notes statistically often precedes major upward movements.

“Exchange balances have now declined for 98 consecutive days, marking the longest drawdown since 2020, which preceded the last major bull market breakout.”

He states historically, such sustained outflows “signal rising scarcity and mounting upside pressure.”

Disclaimer: This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.