Bitcoin Poised for Range Expansion Amid Economic Dataline and FOMC Outlook

Key Events Prompting Market Caution

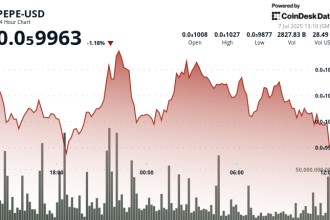

Bitcoin (BTC) has largely traded within a $117,000 to $120,000 range Tuesday. A daily close below $118,000 could potentially trigger a test of deeper support around $110,000-$114,000.

Technical indicators suggest accumulated volatility or “price compression,” possibly a precursor to a renewed directional move. However, risk aversion is evident as traders cut exposure ahead of several high-impact events:

- U.S. Federal Open Market Committee (FOMC) meeting minutes release.

- A high-waited White House report detailing the U.S. government’s crypto policy stance.

- Publication related to a potential U.S. strategic Bitcoin reserve.

The White House cryptocurrency report and associated strategic reserve news are closely watched as potential catalysts for a market turnaround.

Fed Policy Stance and Interest Rate Dials

While market attention centers on Wednesday’s Crypto White Paper, Fed Chair Jerome Powell will also speak. CME FedWatch currently indicates a 98% probability the Fed will maintain the 4.25% to 4.5% interest rate range ahead of its imminent decision.

Despite presidential calls for rate cuts, the FOMC’s next move hinges on incoming economic data. Traders will monitor nonfarm payroll, PMI releases, GDP, and other indicators known as soft data for policy cues.

Notably, large-cap altcoins have largely followed BTC lower, reinforcing an across-the-board risk-off sentiment ahead of the scheduled news flow.

Retracing the Correction: Volatility Patterns Shift

Bitcoin’s average intraday volatility has diminished by more than 45% over the past three weeks. Factoring an impending data-rich day, analysts suggest a market re-pricing could establish a wider range, potentially extending upward targets if catalysts align, or venturing downward towards the $110,000 valuation levels.

Technical setup, featuring compressed Bollinger Bands alongside the persistent price range, signals a possible imminent range expansion event.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.