Bitcoin’s proximity to an all-time high ($111,970) places it in a delicate position as traders monitor potential breakouts. A retest of the $108,000 support threshold could precipitate a “bearish downtrend,” according to crypto analyst Daan Crypto Trades.

Analyst Cautions on Key Support Level

In remarks from Thursday, Daan Crypto Trades advised, “You don’t want to see this deviate back below $108K again at this point,” describing the situation as “attempting a breakout.”

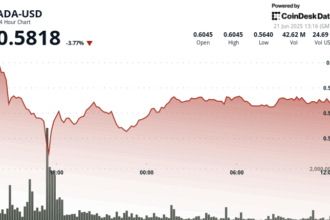

Current data from CoinMarketCap shows Bitcoin trading near $109,250, approximately 2.5% below its record peak. “Any closes up around this $110K region would be good,” echoed the analyst.

If Bitcoin falls back to $108,000—a level recently recovered—Daan cited the possibility of a downward cascade to $96,000. CoinGlass data indicates this scenario could force approximately $2.67 billion in open long positions into liquidation.

Contrasting Market Opinions

Despite cautionary notes, other analysts express confidence in an upward trajectory. “It’s very hard to be bearish here,” stated Crypto Analyst Miles Deutscher.

CryptoFayz, meanwhile, posited that a confirmed breakout above $111,960 could sustain momentum toward $116,000.

10x Research’s Markus Thielen highlighted institutional inflows into Bitcoin ETFs, Fed uncertainty, and reduced supply on exchanges as factors potentially supporting higher prices, suggesting $116,000 could be reached by end-July.

Market Structure Under Scrutiny

Daan further observed that Bitcoin’s current consolidation phase diverges slightly from historical patterns in this cycle. “It is still following the same pattern where it stalls, deviates below, retakes the range and then grinds higher. It is missing the actual breakout and continuation,” he concluded.

Market veteran James McKay commented on the implications of protracted consolidation phases, suggesting they deviate from typical Bitcoin market cycles.

Related: Bitcoin price aims for new highs but ‘divergences’ set $110K as resistance

Magazine: Bitcoin vs stablecoins showdown looms as GENIUS Act nears

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.