Bitcoin Nears Key Technical Levels as Bullish Rebound Continues

SOURCE: Cointelegraph, TradingView, CoinGlass, Coinank, X (Twitter), Rekt Capital (@CrypNuevo)

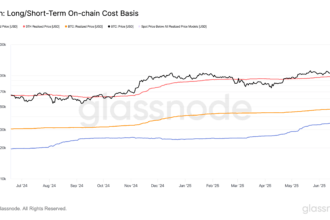

Bitcoin (BTC) staged a notable comeback late in the trading week, staging a recovery for its weekly closing levels as traders scanned crucial price points for the upcoming session. Data from Cointelegraph Markets Pro indicates the cryptocurrency is attempting a reclaim near the daily 10-day simple moving average (SMA) support, having rebounded from near $114,500.

The price surged back above the $119,000 threshold on Sunday, extending a renewed buying interest from two-week lows reached during the previous week. This upward movement occurred amidst anxieties about potential trade friction easing after reports that the U.S. and China agreed to a temporary extension (90 days) on previously paused reciprocal trade tariffs.

Focus on Key Reclaim Levels: $119,500 and $120,000 Targets

Market participants are intensely focused on technical levels as the Bitcoin market consolidates. Investor and entrepreneur Ted Pillows suggested that a break above $119,500 could signal a significant upward move, while acknowledging that if this doesn’t occur, the consolidation phase could persist into next month.

Analyst Rekt Capital noted that Bitcoin already closed daily above the blue range low, initiating a potential “break back” into briefly lost territory. The analyst emphasized monitoring dips back towards the Range Low to confirm the move.

Meanwhile, technical levels near $120,000 act as a key resistance zone. Analyst and liquidation map provider CoinGlass highlights a dense cluster around this zone as a primary liquidation area, with a mid-term downside target identified near $114,500 – $113.6k.

Volatility Expected Amidst Large Orders and Short Positions

Analysts caution that volatility remains a distinct possibility due to anticipated large-volume trading behavior and the dynamics of open short positions.

CrypNuevo, a fellow trader, identified range-bound characteristics, suggesting price could target the upper liquidation cluster near $120k first before probing the lower $114.5k-$113.6k cluster.

Short position risk also adds to the volatility outlook. CoinGlass data indicates open short volumes on centralized and decentralized exchanges are highest below approximately $123k, with maximum potential loss (Max Pain) calculated around $119,650 for short sellers. A successful move above $123k could trigger over $1.1 billion in automatic liquidation.

The technical analysis platform Coinank confirmed “strong resistance” forming in the $119,000–$120,000 vicinity based on liquidity data.

Warning of Potential Larger Swings

TheKingfisher (“DealerGamma”) added a significant caution on Sunday, citing the BTC Gamma Exposure and Volatility Index (BTC GEX+) chart. The indicator showed “predominantly red,” suggesting market makers are heavily short gamma positions. This, the analyst warned, implies dealers may “amplify volatility” to hedge, leading to “potentially larger price swings” on shorter timeframes.

This article is for informational purposes only and constitutes neither investment advice nor a recommendation to take any position on digital assets or any other investment security. Trading and investing in any cryptocurrency involves substantial risk and potential loss.