Global Crypto Market Suffers Significant Decline amid Escalating Middle East Tensions

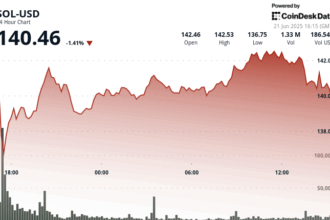

Major cryptocurrency prices experienced sharp declines on Sunday morning following the U.S. military’s retaliatory strike against Iran. Key indicators, including Bitcoin and Ethereum, dropped to their lowest levels in months.

According to reports from data provider CoinGecko, Bitcoin fell below the $100,000 threshold for the first time since early May, trading near $99,843 late Sunday. Ethereum saw a more substantial drop, declining over 10% to approximately $2,171, marking its lowest price since early May.

The downward shifts came after the United States entered the conflict between Israel and Iran, with President Donald Trump announcing late Saturday that U.S. forces bombed three Iranian nuclear facilities in an attack dubbed Operation Midnight Hammer.

The retaliatory strikes, described by the administration as “Operation Midnight Hammer,” are part of the ongoing hostilities between Israel and Iran. Market analysts suggest that these developments are causing increased geopolitical uncertainty, negatively impacting risk-sensitive assets like cryptocurrencies.

Altcoins, while less severely affected than the leading cryptos, also saw price corrections. XRP, Solana, and Dogecoin traded at levels not seen since February. CoinGlass reported that liquidations across the crypto market reached $949 million within the previous 24 hours, with Ethereum and Bitcoin being the most liquidated assets.

The overwhelming majority of these liquidations involved leveraged long positions. Furthermore, market sentiment worsened as participants on prediction platform Myriad increasingly favored a bearish outcome for Bitcoin’s price. The probability of Bitcoin dropping below $95,000 increased dramatically to nearly 65%, reversing previous bullish sentiment.

This sharp market correction underscores the continued sensitivity of cryptocurrency valuations to international geopolitical tensions. The full extent of the military operation’s impact on global financial markets, including the crypto sphere, remains to be assessed.

(Disclosure: This is an analysis based solely on publicly available information. The prediction data originates from an affiliate platform.)