U.S.-China Trade Talks, Crypto Market Shift Focus Ahead of Fed Decision

Stockholm-based discussions between the U.S. Treasury and China’s trade officials have kept U.S.-China trade simmering, but discussions on extending the current 90-day tariff pause beyond August 12 failed to result in agreement. The existing framework leaves a significant 30% tariff on certain Chinese imports heading to the U.S. and a 10% tariff on U.S. goods bound for China in place.

Discussions on Tariff Extension

In talks led by U.S. Treasury Secretary Scott Bessent and Beijing’s top trade negotiator Li Chenggang, both sides acknowledged the possibility of discussing an extension. Bessent later clarified that while extension was discussed, a definitive agreement was not reached.

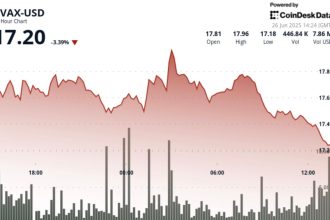

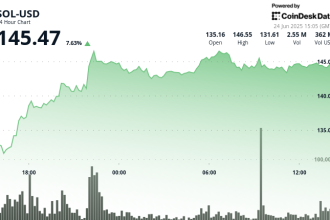

Crypto Market Pauses Amidst Diplomatic Tone

While U.S.-China trade officials met constructively in Stockholm, the crypto market remained largely stationary on Tuesday, with Bitcoin dipping slightly to around $118,000 following the diplomatic engagements. President Donald Trump separately indicated a potential visit to China, contingent on an invitation from Chinese President Xi Jinping.

Macro Focus Turns to Fed Meeting

The primary market attention now shifts to the upcoming Federal Reserve meeting later this week. Markets currently price in a high probability (65.4%) of a rate cut by September.

All eyes are on Federal Reserve Chair Jerome Powell’s tone during the upcoming FOMC meeting. Signs of “economic weakness” could strengthen “rate cut odds,” explained Daniel Liu, CEO of Republic Technologies.

Liquidity Implications

Lower interest rates typically create a more favorable environment for risk assets as they make borrowing cheaper, incentivizing investment in higher-return holdings like cryptocurrencies or stocks over traditional, lower-yield options like bonds. Economists argue particularly that potentially sweeping tariffs proposed by the White House could exacerbate the Federal Reserve’s ongoing fight against inflation, adding another layer of complexity to the central bank’s policy considerations.