Bitcoin (BTC) Eyes $116K Resistance Amid Stronger Than Expected Rebound

Bitcoin (BTC) staged a substantial bounce following the weekend and the reopening of traditional finance (TradFi) markets on Monday morning. As bulls target the significant resistance level around $116,000, ongoing exchange order-book congestion and healthy levels of futures leverage dictate cautious optimism.

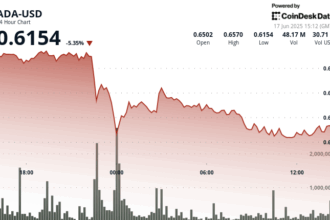

Data from sources including Cointelegraph Markets Pro, TradingView, and CoinGlass indicated Bitcoin briefly challenged the $115,732 mark on Bitstamp after the Wall Street open. A major congestion point emerged around the $115,800 level.

Technical analysts view the recent price action through several key frameworks:

- The CME Daily Gap: Rekt Capital highlighted Bitcoin’s move “completely filled the Daily CME Gap,” interpreting this as a precursor to an attempt to reclaim previously tested levels. Overcoming the $116,000 area, identified as the top of this gap, is considered critical.

- Bid/Ask Structure: CoinGlass data depicted a dense cluster of sell orders near $115,850 referenced by trader BigMike7335, placing $112,000 and the older $110,000 level as zone of increasing support. Cipher X further suggested establishing a $110.5K bounce if downside pressure mounts first.

A notable instrument for gauging liquidity pressure is the CoinGlass BTC liquidation heatmap.

Trading firm QCP Capital offered an optimistic perspective in its Telegram bulletin, noting BTC’s July monthly close marked a historical high, suggesting the current correction might gather strength rather than signal capitulation.

“BTC’s July monthly close marked its highest in history, and the recent drawdown appears more corrective than capitulatory.”

The firm underscored that while macroeconomic uncertainty remains, recent shakeouts that clear excess leverage have previously preceded accumulation phases. A key indicator highlighted was Monday’s Bitcoin ETF outflows.

While QCP remains “cautiously optimistic,” the $112k level continues to warrant scrutiny. Stabilizing signals are expected to include:

- Renewed inflows into spot BTC ETFs

- Declining implied volatility

- Normalization of skew indicators

Despite the positive technical narrative and institutional positioning considerations, the substantial open interest in Bitcoin futures, confirmed by CoinGlass to sit near its lowest levels since July 10, underscores lingering market activity and risk.

The upcoming flow data for US spot Bitcoin ETFs on Monday (within this revised text) is expected to offer further clarity on market sentiment and potential near-term price dynamic.

This analysis is for informational purposes only and does not constitute investment advice. Trading and investing in Bitcoin involves significant risk.