BTC Long-Term Holder Position Signals Potential Rally to $150K

Analysis suggests bullish case strengthened as 80% of circulating supply now held by long-term holders

- Historically, BTC supply held by long-term holders exceeding 80% precedes significant price rallies of 72-84%

- Current market conditions show similar fractal pattern to previous breakout points

Historically significant positioning appears to be underway in the Bitcoin market, with analytics suggesting a potential surge in prices as high as $150,000. According to CrediBULL Crypto’s analysis, 80% of all Bitcoin currently in circulation is now held by long-term investors.

Historical Pattern Indicates Potential Rally

Analysis of long-term holder (LTH) supply shows that the current percentage represents an all-time high for this period in Bitcoin’s 15-year history. Previous instances occurring in February and October 2024 resulted in subsequent market rallies of 72% and 84% respectively.

“Over 80% of all the Bitcoin that will ever exist is currently being HODL’d,” the crypto analyst shared on Twitter. This level of concentration among long-term holders represents a structural shift that could significantly impact market dynamics.

When Bitcoin enters new highs with its supply predominantly held by long-term investors, market sentiment concerning future price appreciation strengthens substantially. According to CrediBULL Crypto, the current concentration suggests “the next impulse is imminent” with potential upside significantly exceeding previous market cycles.

“Now that ‘excess’ supply has found its way back in the hands of long-term holders and with Bitcoin treasury companies leading the way, the next impulse is imminent. This next one will also likely be even bigger than the last two ($50,000+).”

Bullish Trading Positions Formed

In parallel with this supply analysis, Bitcoin traders are increasingly positioning themselves for substantially higher prices. The activation of September $130,000 call options on Deribit indicates growing conviction among institutional participants regarding potential upside.

“Vols remain pinned near historical lows, but a decisive breach of the $110,000 resistance could spark a renewed volatility bid,” reported QCP Capital. “Some larger players appear to be positioning for just that.”

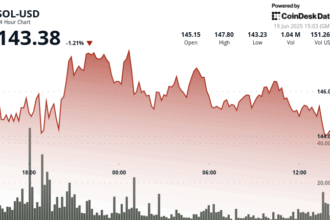

Technical analysis reveals significant liquidity clusters and heavy ask orders positioned just above the current trading ranges. Market structure appears primed for a breakout from the $100,000-$110,000 consolidation zone, potentially reaching $130,000 or beyond.

This current market situation represents what analysts describe as a classic “supply shock” scenario. With a significant portion of the circulating supply now held by long-term holders, any meaningful increase in demand could trigger substantial price appreciation, bypassing recent resistance levels.