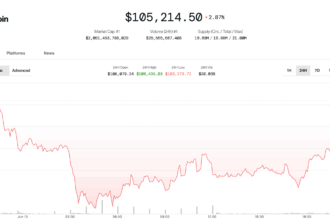

Bitcoin Accumulation Strength Drives Rally to $113,800

- Bitcoin climbed to $113,800 as on-chain data shows a 71% surge in BTC holdings by accumulator addresses.

- Bitcoin’s MVRV ratio suggests significant profit-taking may start when BTC approaches $130,900.

- $4.4 billion increase in BTC’s realized cap indicates concrete investment inflows.

Bitcoin (BTC) surged past the $113,800 mark Thursday as on-chain data highlighted a substantial uptick in buying activity from ‘accumulator’ addresses.

According to CryptoQuant data, these specific accumulation addresses collectively held 248,000 BTC on Wednesday, setting a new yearly high in accumulation activity. Their seven-day demand increased 71%, from 148,000 BTC on June 22nd.

This demand spike mirrors the peak seen in December 2023, when accumulator addresses held an all-time high of 278,000 BTC at a lower $97,000 price level. This repetition at higher prices underscores sustained investor conviction.

Meanwhile, demand momentum data indicates buyers are increasingly dominant after a period of negative cumulative demand. The swift recovery confirms strategic accumulation activity currently outpaces short-term selling pressure.

Analysis: Delayed Profit Taking Expected

Market analysis points to another potential resistance level at $130,900, calculated using the Market Value to Realized Value (MVRV) ratio reaching a 2.75 ratio.

Investment firm Glassnode bolstered this view by noting a $4.4 billion jump in BTC’s realized cap as it broke above $113,000. Realized cap measures the total cost basis of all coins at their last transaction price, acting as a powerful indicator for actual capital inflows, distinct from market speculation.

Despite the strong buying momentum, analysts like Kyle Reidhead from Milk Road anticipate further upside, citing technical chart patterns. The potential $150,000 target remains on the table if current accumulation trends persist before any correction materializes.

Related: Glassnode: Glassnode Collateral Bitcoin ETF Assets Dip Slightly in July, But Holdings Stable

Related: MarketWatch: Bitcoin ETF Flows Signal Continued Demand Amid Market Speculation

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.