Bullish Engulfing Pattern Suggests Bitcoin’s Next Move

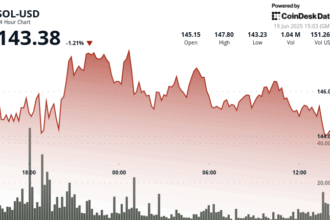

Bitcoin (BTC) last closed Monday with a potent 4.34% daily gain, cementing a powerful bullish engulfing candlestick reversal pattern on its daily chart. This formation completely overturned bearish momentum observed over the preceding two days, signaling potential structural shifts. More significantly, BTC held crucial support above the $105,000 threshold for two consecutive sessions, reinforcing ongoing market recovery expectations.

To evaluate the reliability of this signal, Cointelegraph conducted a comprehensive review of all applicable bullish engulfing candlestick formations on BTC’s daily chart since 2021. The analysis incorporated supplementary criteria to validate the pattern’s strength, including the engulfing candle covering at least two prior candles and its appearance at the conclusion of a corrective phase, aiming to signify a reversal trend.

Between January 2021 and the present date, instances meeting the specified confirmation criteria yielded 15 occurrences of subsequent new regional highs over ensuing days or weeks. This translates to an impressive historical success rate of approximately 78%, calculated across 19 patterns.

In the recent two years (2024 and 2025), there were two notable exceptions where the pattern did not directly precede new price highs – observed in May 2024 and March 2025. Despite these deviations, the prevailing macro-trend significantly bolsters the likelihood of continued upside momentum.

Crucially, contrasting analyses reveal that these bullish signals for BTC almost functioned exclusively within extended bull markets. During the 2022 bear market, four bullish engulfing patterns were identified, universally resulting in significantly lower outcomes, with three concentrated within that year. This contrast underscores the vital role of the prevailing market trend context.

Favorable Liquidity Levels Underscore Bullish Narrative

Market conditions currently suggest Bitcoin is displaying liquidity metrics not witnessed since late 2022. Even amidst persistent concerns, BTC’s trajectory perfectly mirrored a post-cycle nadir pattern, ultimately doubling its value over an approximately three-month period following a $16,800 trough.

Furthermore, despite evolving macroeconomic conditions and regulatory landscapes, liquid capital consistently moves towards Bitcoin during enhanced capital inflow periods. Current data points suggest capital flows into the cryptocurrency ecosystem are resuming, a recurring feature of Bitcoin’s historical behavior.

Quantitatively, marked evolution reveals that since the 2022 cycle low, inflows exceeding $544 billion have swelled BTC’s internal network liquidity or realized market cap to an unprecedented $944 billion – surpassing previous peaks.

Analyst views on Bitcoin reach $112K

This article is intended for informational purposes only and does not constitute financial investment or trading advice. All investments carry inherent risks, and decisions should be independently verified by individuals conducting thorough research.