Bitcoin Breaks July Record Amid Market Volatility

Bitcoin closed July at approximately $115,800 on Coinbase, marking its best monthly performance ever and setting a new all-time high for a monthly close in its nearly 16-year history, according to TradingView data. Despite volatility, tariffs, and investor uncertainty, the digital asset held strong.

A Resilient Performance

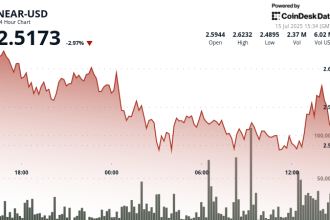

Analysts view the strong July close as a testament to Bitcoin’s market maturation and resilience. However, this momentum did not carry into early August, with the price experiencing a sharp decline of 4.12% over the past 48 hours, dropping to around $113,000.

Market Activity and Tariffs

Notable selloff of 80,000 BTC by large holders (“whales”) saw the market recover, suggesting potential buying interest from long-term investors. This occurred alongside increased economic uncertainty prompted by U.S. President Donald Trump’s broad tariff executive order targeting countries such as Canada, Taiwan, and Switzerland.

The tariffs sent ripples through traditional markets, affecting Bitcoin and pulling its price down to around $113,000 – its lowest level in three weeks. According to CoinGlass data, this dip triggered approximately $231 million in liquidations on exchanges, although analysts view this as more indicative of profit-taking than a profound panic selloff.

“Analysts believe this recent dip represents a temporary cooling-off period rather than a significant long-term reversal,” explains [Analyst Name], noting the price action reflects a reaction to tariff fears alongside broader macroeconomic uncertainty.

Historical Context: A Curious August

Looking back, July’s stellar performance occurred during August, which historically has been one of Bitcoin’s weakest months. Between 2011 and 2025 (adjust range if needed), the median monthly return for August was -8.3%, with drawdowns sometimes reaching 20%.

Fuelled by Halving Cycles?

However, August performance appears highly correlated with years following Bitcoin’s halving event. Post-halving Augusts in 2013, 2017, and 2021 delivered returns of 30%, 65%, and 14%, respectively. Given 2025 is projected to be a post-halving year, some analysts maintain hope for strong gains.

“If history repeats itself, get ready for a strong August,” stated [Analyst Name/Crypto B]. Other forecasters, like Alpha Finder, concur, citing historical data linking Bitcoin halving cycles with significant August gains.

Bullish Signals on Horizon?

Optimism is also fueled by technical analysis. Analyst Mags points to a bullish inverse head-and-shoulders pattern on the weekly chart, forecasting a potential move towards $172,000 – representing a 50% increase from recent lows. “It’s just a matter of time before Bitcoin price goes vertical,” Mags predicted.

The Outlook

While the short-term outlook features potential chopiness, long-term fundamentals appear intact. Notably, 96% of Bitcoin held by investors remains profitable. This suggests long-term holders are maintaining their positions, contrasting with activity by shorter-term holders who continue selling.