Bitcoin Reacts Sharply Lower to US-Iran Conflict News

Key Takeaways:

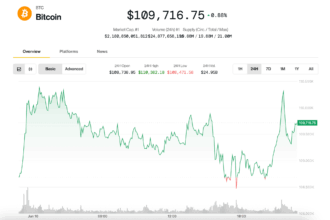

- Bitcoin (BTC) dipped below $102,000, approaching new month-to-date lows.

- Analysts cite a historical tendency where geopolitical conflicts can initially pressure but often boost BTC.

- Key potential support level identified at approximately $97,000 based on order book analysis.

Bitcoin (BTC) experienced a sharp decline, trading near $102,000 on Tuesday June 25, following reports of direct U.S. involvement in the ongoing Israel-Iran conflict. President Donald Trump confirmed strikes on Iranian nuclear facilities in a broadcast to his Truth Social followers.

Taking aim at the Islamic Republic, Trump stated during a televised address that Iran “must now make peace” or face further strikes.

Geopolitical tension, particularly involving major powers and potential global impact, has historically acted as a catalyst for Bitcoin prices in the past, although often leading to initial declines before potential rebounds. Traders assessed the potential for a bottom formation.

Famous crypto trader Cas Abbe suggested, “A dump towards $93K-$94K before bottom formation and reversal,” noting only a “20%-25% chance” of a deeper dip to the low $90,000 zone.

Historical comparisons were drawn by other traders. Referring to the Ukraine conflict’s start in 2022, trader Merlijn commented, “$BTC pumped +42% in 35 days after the Ukraine war began. That was deep in a bear market. Now it’s 2025. War fears rise again. But Bitcoin’s above $100K. And we’re still in a bull market. What happens if history repeats with more fuel?”

Despite the dip, the bulls face a challenge. “I remain long over $93,500, but remember i really want to see the $104,500 hold for the bulls to remain in control,” another trader, Crypto Tony, noted ahead of the upcoming trading week.

Data from CoinGlass highlights the $97,000 area as significant based on exchange order book liquidity, suggesting it could serve as a crucial potential support band.

BTC/USD is currently trending lower on a one-hour chart (Source: Cointelegraph/TradingView). On a more extended timeframe, the daily, weekly, and liquidation heatmap data show Bitcoin continuing its path towards what could be its lowest weekly close since May.

This article is not investment advice. Cryptocurrency trading carries substantial risk.

Bitcoin (BTC) risked new month-to-date lows into the June 22 weekly close as geopolitical threats soured crypto sentiment.

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD falling under $102,000 as US President Donald Trump confirmed strikes on nuclear facilities in Iran.

Ahead of what promised to be a volatile open to the Wall Street trading week, Bitcoin traders began considering potential BTC price bottom levels.

BTC/USD thus remained on course for its lowest weekly close since the start of May. Data from monitoring resource CoinGlass showed that the area remained significant.

BTC liquidation heatmap data is shown below (Source: CoinGlass).