Analysis of recent market sentiment from prominent Bitcoin traders indicates sustained bullishness, with many anticipating fresh all-time highs this year.

Key Market Sentiment

- Traders see $270,000 price levels as achievable targets by October.

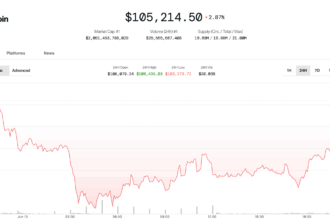

- Ongoing price consolidation above $100,000 is viewed as a precursor to significant gains.

- Doubts continue to exist regarding the nature and severity of potential future bear markets.

Bullish Signals and Price Projections

Despite recent price consolidation, analysts argue the prevailing market structure points towards a substantial ascent.

Alan Tardigrade, a noted trader, observed an “Ascending Broadening Wedge” developing on weekly charts in late May, projecting a potential breach of $170,000.

“This pattern has recently formed for weeks and is expected to reach $170k levels.”

Tardigrade further analyzed a “golden cross” on daily charts (“50-day SMA crosses 200-day SMA”), noting a historical average gain exceeding 100% from such signals since late 2023. He suggested intermediate targets around $152k and $229k.

“If $BTC experiences its worst and best gains from this point, it could reach $152k and $229k. These targets are reasonable given the recent uptrend.”

Traders aren’t the only voice echoing bullish sentiment. For instance:

“$BTC, possible wave 2 down to $92k would build nice momentum till October around $270k”

Merlijn has identified what he describes as an “inverse head-and-shoulders pattern,” signaling a potential breakout above $140,000 with the neckline near $113,000.

“Breakout target? $140K+,”

“Neckline at $113K is the only thing standing in the way.”

Bear Market Outlook

Conversely, some experts are increasingly skeptical about the sustainability of the current bull run.

Historical comparisons to the 2021 bull market peak are surfacing, highlighting the consistent resistance encountered in previous all-time high areas.

“Bitcoin has done -70% and -80% before, and it can do it again,” countered The Bitcoin Standard author Saifedean Ammous during a recent industry event.

Disclaimer

This article is not investment advice. Trading and investing in digital assets involve significant risk. Please conduct your own research before making decisions.