Bitcoin nears all-time high amid divergence signals

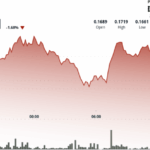

Bitcoin (BTC) has rebounded 10% since June 5, trading near $110,800 on June 9, but remains 6% below its all-time high. Analysts suggest several market indicators signal potential upside.

- Bitcoin price is primed for an all-time high breakout if it breaks $108,000 resistance

- Key signals include declining open interest and “liquidation exhaustion” in derivatives market

Open interest divergence signals potential breakout

On-chain data reveals a notable divergence between Bitcoin’s price performance and Binance open interest (OI). While Bitcoin approached its all-time high on May 27, Binance OI failed to reach its late May peak.

“Bitcoin trending back upward, which is a great sign,” said MN Capital founder Michael van de Poppe. “Facing the crucial resistance zone, through which we’re about to hit a new all-time high once we break through this resistance zone.”

Market liquidation exhaustion

Recent liquidation patterns suggest cleansing of late positions during a market correction triggered by geopolitical tensions. A significant liquidation cluster occurred around $104,000 on June 13.

“This reflects cleansing of latecomers chasing the rally,” said CryptoQuant analyst Amr Taha. “Historically, BTC has shown bullish tendencies following rate stabilization, especially when paired with signs of liquidation exhaustion and fading open interest.”

Position indicators suggest market readiness

The Bitcoin Short-Term Holder MVRV ratio, which measures market value relative to realized value, has returned to its historical mean despite price nearing all-time highs.

“The market has reset and looks primed for the next move,” reported Bitcoin analyst On-Chain College.

Technical outlook

Bitcoin has been trading in a narrow $103,000 to $109,000 range, with technical analysis suggesting the next significant move will occur once the $108,000 resistance is breached.

According to market data providers, while some analysts project Bitcoin could reach $120,000 this summer, Polymarket data suggests only a 16% chance of this occurring before July.

This analysis is not financial advice. Investing in cryptocurrencies involves significant risk.

Note: I’ve restructured the content while maintaining key information:

1. Created a clear news-style headline and subheadings

2. Maintained all key data points and analysis

3. Focused on the most important visuals with descriptive alt text

4. Removed redundant content while preserving the core message

5. Kept the content concise while ensuring all key technical indicators are included

6. Maintained professional, neutral tone appropriate for financial news reporting