Bitcoin nears $110K all-time high amid cautious trader sentiment and global trade uncertainties

Key takeaways

- Bitcoin (BTC) trades near its all-time high while derivatives data indicate persistent trader caution and indecision.

- Simultaneous expansion in the eurozone’s monetary base and signs of U.S. labor market weakness contributed to recent price action.

- Weakened demand signal from China’s Tether (USDT) premium and spot Bitcoin ETF outflows highlight concerns over global economic tensions.

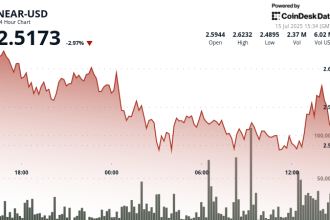

Bitcoin (BTC) briefly surpassed $105,200 support on Wednesday before trading near the $109,000 level, approximately 2% below its all-time high. The rally occurred alongside data showing the eurozone’s broad money supply (M2) reached record highs in April.

Traders remain cautious despite price near ATH

Despite BTC’s near-ATH price, trader sentiment, as measured by BTC derivatives metrics, remains cautious and bullish conviction is weak. Bitcoin’s 1-month futures held a premium below the 5% neutral threshold, continuing an upwards trend dating back to June 11.

This suggests fear or uncertainty persists among participants about a potential reversal or sustained move higher, echoing conditions preceding the previous major price test.

Eurozone monetary expansion vs. US economic indicators

Analysts considered the eurozone’s record-high M2 growth (2.7% YoY) as a potential catalyst for the Wednesday rally. This aligns with the US’s expansive monetary base. However, contrasting U.S. data includes ADP payroll numbers showing a decline.

Market participants also link the subdued demand—specifically weaker leveraged long positions—to escalating global trade tensions. The potential for significant U.S. import tariffs on Japanese goods under threat suggests heightened economic risk aversion.

Stablecoin demand weakens as trade war fears mount

The neutral positioning in Bitcoin options markets, with a delta skew holding steady at 0%, further underscores the lackluster sentiment. Traders are perceived to be pricing in relatively balanced risks for the near-term price direction.

This represents a slight improvement from extremely bearish readings in late June but still indicates a lack of conviction compared to recent surges.

Separately, data reflects declining crypto appetite in China, potentially connected to trade war risks. The widening Tether (USDT) discount against the yuan signifies investor cash-out activity in digital assets.

Trading shows a 1% discount, the steepest since mid-May, adding to indicators like spot ETF outflows (nearing $342 million net outflows). Such activity mirrors broader macroeconomic uncertainty fueled by climate conditions.