Bitcoin’s Risk Profile and Seasonal Patterns Under Scrutiny

Key takeaways:

- Analysts indicate Bitcoin (BTC) is trading more as a risk asset like US equities rather than a safe haven like gold, challenging its “digital gold” narrative.

- While a potential Fed rate cut could support BTC, historical data shows Q3 tends to be flat, with a 1% median return from June to September over the last decade.

- Bitcoin’s volatile nature is contrasted with gold, which showed improved risk-adjusted returns (higher Sharpe ratio), despite both assets benefiting from macroeconomic uncertainties.

Bitcoin (BTC) experienced a week of muted movement, reflecting its sensitivity to prevailing macroeconomic conditions and geopolitical tensions. While gold prices potentially found support due to an 8.5% year-on-year increase in the global money supply, Bitcoin’s trajectory appears distinct, underscored by its rising Sharpe ratio, which suggests improved risk-adjusted returns similar to gold.

However, the crypto asset’s dual characterization—as both a potential store of value and effectively a “Nasdaq proxy”—continues to undermine price stability. According to Markets analyst Tony Sycamore, Bitcoin trades more like risk assets (US equities) rather than safe-haven assets like gold in the current market environment. Similarly, Nick Ruck from LVRG notes that the “digital gold” narrative is losing traction, with traders increasingly focused on short-term volatility rather than BTC’s risk-adjusted profile.

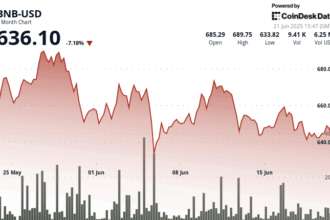

Fed Policy and Q3 Seasonality

The Federal Reserve maintained rates steady, but the possibility of a July rate cut was raised by Fed Governor Christopher Waller. Historically, such events could fuel a Q3 rally, yet data reveals a stark contrast: the median 4-month return period from June 1 to September 30 over the past 10 years has seen a modest 1% total return. This inherent flatness typically keeps BTC above $100K for most of the period, with notable rallies reserved for Q4.

Recent technical analysis points to persistent bearish momentum. After a failed attempt to reclaim the $106,000 level earlier this week, BTC faces potential resistance near $102,614, with a significant decline towards $100,000 a possibility if selling pressure intensifies, aligning with key support levels.

Gold vs. Bitcoin: Sharpe Ratio Insights

Director of Global Macro at Fidelity, Jurrien Timmer, highlighted that both gold and Bitcoin exhibit rising Sharpe ratios, indicating enhanced returns relative to their risk. While this could suggest underlying recovery potential for both, Bitcoin’s fluctuating identity—alternating between store of value and Nasdaq-like proxy—presents a significant challenge to its consistent positioning.

This article does not constitute investment advice or a recommendation to engage in any investment activity. Investing and trading financial instruments, including cryptocurrencies, carry inherent risks, including the potential loss of invested capital. Readers should conduct their own research and consult with a qualified financial professional before making any decisions.