Bitcoin Still Mid-Cycle in Adoption, Fidelity Says

Key Takeaways

- Fidelity’s Jurrien Timmer believes Bitcoin is still mid-cycle in its adoption curve.

- 125 public companies now hold BTC, with digital asset products witnessing $3.7 billion in weekly inflows last week.

- First-time BTC buyers accumulated over 140,000 BTC in just two weeks, signaling renewed FOMO.

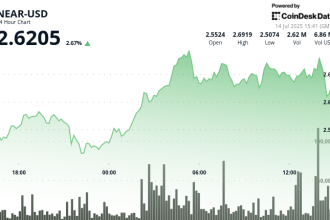

Bitcoin (BTC) may be trading near highs around $120,000, but according to the Director of Global Macro at Fidelity, Jurrien Timmer, it’s still early in the broader adoption cycle.

Follower the Internet Curve

Drawing parallels with the internet boom, Timmer emphasized that Bitcoin’s growth trajectory closely resembles the internet’s adoption curve from past decades. “Bitcoin continues to follow both the Power Law curve of its wallets as well as my demand model based on the internet adoption curve. We are right in the middle,” Timmer stated.

The analysis suggests that the current price action still reflects a maturing, not saturated, asset class. The chart indicates a potential target valuation region of $200,000-$300,000.

Corporate Bitcoin Adoption Grows

Evidence of this early stage includes a significant wave of corporate Bitcoin adoption. Data from Bitwise shows that 46 public companies added BTC to their balance sheets, bringing the total to 125 in Q2. These firms collectively hold 847,000 BTC, valued at approximately $91 billion.

Fueling this momentum, crypto digital asset investment products recently recorded their second-largest weekly inflow, a staggering $3.7 billion. This pushed total assets under management across crypto products to an all-time high of $211 billion, with Bitcoin-backed products accounting for $179.5 billion, i.e., 85%.

📊MARKET UPDATE: [Crypto] digital asset investment products recorded their second-largest weekly inflow ever—a massive $3.7B, pushing AUM to an all-time high of $211B. 📈 pic.twitter.com/cMHBVsD3Tc

— Cointelegraph Markets & Research (@CointelegraphMT) July 15, 2025

Commenting on this capital influx, Timmer noted it remains unclear whether these flows are from long-term believers or short-term speculators. “Whether these flows are from true believers or ‘momentum renters’ is hard to tell,” the Fidelity Analyst noted.

Volcon Joins Bitcoin Treasury Movement

Electric powersports company Volcon became the latest public firm to adopt a Bitcoin treasury strategy. On July 17, the company announced a $500 million private placement with 95% of proceeds earmarked for acquiring Bitcoin, backed by Empery Asset Management and Gemini.

FOMO Resurfaces

Beyond corporate treasuries, Bitcoin’s surge to new all-time highs above $123,000 has attracted fresh retail investors. First-time BTC buyers accumulated over 140,000 BTC in just the past two weeks.

The data signals a return of “FOMO” driven behavior, as new and seasoned participants aggressively buy into the rally. First-time BTC holdings boosted by 2.86%, from 4.77 million to 4.91 million BTC.

This renewed investor interest underscores strong organic demand supporting Bitcoin’s latest breakout.