Okay, here is the rewritten article in a professional news style, formatted appropriately in HTML:

In BRIEF: Bitcoin Recovers Sharply

Bitcoin surged past the $110,000 mark for the first time in nearly two weeks on Monday (local time). The largest cryptocurrency dipped below $101,000 just over a week ago.

In Brief

- Bitcoin briefly traded above $110,000 on Monday, the first time since late May.

- Bitcoin recently fell back to approximately $110,100, still less than 2% below its all-time high ($111,814).

Hopeful anticipation surrounding renewed trade discussions between the U.S. and China contributed to the recovery, alongside reports of significant short position liquidations in the cryptocurrency space.

Bitcoin’s recent rally sees it trade up approximately 3.5% over the past 24 hours and nearly 5% over the last seven days, reversing a decline that began in late May and saw it drop below $101,000.

“

The breakout level signals renewed bullish momentum after consolidation. Holding around $110,000 could pave the way towards $120,000,” stated Joe DiPasquale, CEO of BitBull Capital.

“

Falling below $101,000 on June 5 was part of a correction stemming from late May. Current activity has brought prices dangerously close to the previous all-time high.

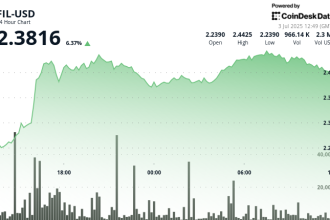

Bitcoin trading volume has also resulted in positive movement for other major cryptocurrencies: Ethereum rose 4.5% to over $2,640, while Solana climbed 3% towards $160. Even typically volatile “meme” coins showed gains.

Meanwhile, broader financial markets showed signs of reassuredness. The Nasdaq and S&P 500 registered minor gains as trade discussions continued, alongside the notable liquidation of nearly $323 million from crypto shorts, led by over $196 million in Bitcoin positions.

Despite recent strength, overall crypto investor sentiment remains cautious. Historically outflows from Bitcoin and other cryptocurrency Spot ETFs have recently eclipsed inflows, with crypto ETFs collectively exiting their longest six-week streak of net outflows.

Crypto research platform 10X Research views the situation with more optimism: “The market setup appears significantly different… Negative funding rates, patterns indicating market bottoms, and a surge in spot demand combine to create a strong conviction signal.”