BTC Rebounds to $108,000 Amid Fears of Fed Rate Cuts Following US Employment Downturn

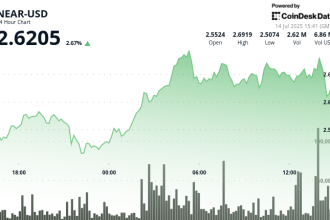

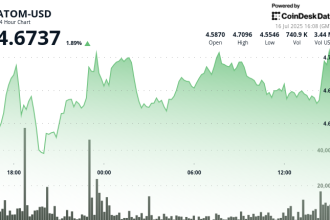

Bitcoin (BTC) surged past the $108,000 mark at the start of the July 2nd Wall Street trading session as a significant miss in US private-sector jobs numbers fueled volatility and intensified expectations for Federal Reserve rate cuts.

Key Takeaways

- The US private-sector jobs decline of over 33,000 in June marked the largest drop since March 2023.

- BTC prices climbed ~2% intraday following the disappointing ADP data.

- $108,000 acts as a key resistance level, triggering a significant wave of short position liquidation.

- Market expectations for a Fed rate cut later this year are growing, which could provide positive catalysts for cryptocurrency markets.

A Disappointing Employment Report Sparks Volatility

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rising approximately 2% during early trading hours in New York. This upward momentum closely followed a surprising slump in the Automatic Data Processing (ADP) National Employment Report. The report indicated a 33,000 decline in private-sector payrolls for June, hitting the lowest level since March 2023. This figure significantly missed the consensus estimate of approximately 90,000 new jobs.

ADP Chief Economist Nela Richardson attributed the job losses to “a hesitancy to hire and a reluctance to replace departing workers” in the current economic environment.

Fed Rate Cuts Expected: A Positive Factor for Risk Assets

The disappointing employment data heightened expectations for the Federal Reserve to begin cutting interest rates sooner rather than later. Lower interest rates typically make riskier assets like equities and, in turn, cryptocurrencies more attractive compared to safer Treasury bonds.

This prospect was noted by crypto market commentators. Andre Dragosch, European Head of Research at Bitwise, stated, “Fed rate cuts are becoming increasingly likely in July…”

However, CME Group’s FedWatch Tool data indicated market sentiment towards the first rate cut remains unchanged by the ADP data, with the September meeting still the most likely venue for the cut. Despite growing calls for reductions, including from President Trump demanding rates “fall to 1% or lower,” market consensus hasn’t shifted dramatically.

BTC Breaks Resistance: Order-Book Dynamics Gain Focus

The recent $108,000 price level is attracting significant attention due to its role in triggering order-book liquidations. Sources like CoinGlass noted that the push to this key psychological and technical threshold began clearing a large accumulation of sell pressure (short positions).

Analysts like TheKingfisher described $108,000 as strategically placed “magnets” supporting the price, citing a lighter presence of buy-side liquidations below this level until the 104,000-105,000 range.

Traders also view the recent action as a “liquidity grab,” with accumulating short positions now facing significant losses.

“liquidity grab and now shorts trapped.”

Despite widespread predictions of Bitcoin reaching new all-time highs in July, the current price action confirms $108,000 continues to function as a significant local resistance level.