Bitcoin nears $107,000 handle amid liquidity surge and Fed policy speculation

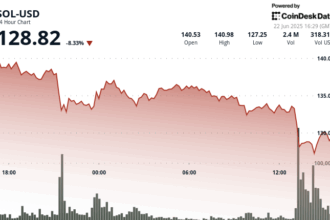

Cryptocurrency markets saw as Bitcoin (BTC), the leading digital asset, edged towards a potential key price handle around $107,000. The approach was fueled by mounting exchange liquidity and technical indicators suggesting pressure on short sellers, although fundamental catalysts related to potential Federal Reserve policy shifts also contributed to market positioning heading into month and quarter ends.

BTC Price Action and Technical Pressure

Data aggregated by Cointelegraph Markets Pro highlighted rising exchange order-book liquidity during the pre-market session. The cryptocurrency dipped approximately 1.1%, establishing a path towards the $107,000 zone. According to analysis from trading firm QCP Capital, this liquidity build-up is notable.

**Observations:**

- Bitcoin perpetual funding rates flipped from near zero or negative to positive across major exchanges, indicating an increase in leveraged long positions.

- Positioning appears driven by directional bets ahead of the close-out of financial quarters.

- A pronounced

short squeeze risk was flagged by analysts.

“With BTC spot edging toward $108k, we’re beginning to see a build-up in leveraged longs as perpetual funding rates flip from flat to positive across major exchanges,” noted a QCP Capital bulletin previously disseminated to Telegram users. “Positioning appears to be chasing the move…”

Amplifying concerns about short positions, prominent crypto trader @TheKingisher cited a substantial concentration of short liquidations just above the $108,000 mark on platforms like Bybit.

“Below us, a cluster of long liqs around 106k-107k. But above? A HUGE wall of short liquidations immediately above current price, peaking fiercely around 108k-108.5k!”

@TheKingisher

The potential consequences of price breaking through approximately $107.5k were deemed “brutal” by TheKingisher, citing the proximity of these “long liqs” and the subsequent activation of the “HUGE wall” of short liquidations.

Liquidity Surge and Price Discovery

Daily market analysis from @RektCapital framed the current situation as a “final resistance battle” on the daily chart, preventing bears from consolidating profits and opening the door towards long-term downtrend challenges.

“After having launched from this local green area of support… Price is now pulling back into this region for another retest,”

@RektCapital

A reversal candlestick pattern near the crucial $107k-108k zone was interpreted by some as evidence of forced buying (or liquidation) pent up below the area and a reluctance for selling to push the price significantly lower before the month’s close.

Broadening Scope: Fed Policy and Potential Market Turmoil

While Bitcoin moves are often self-contained, external financial developments added a layer of bullish speculation. The potential removal of US Federal Reserve Chair Jerome Powell generated significant commentary.

“[Powell’s] refusal to lower interest rates is a point of contention…” the original Cointelegraph report referenced.

Simultaneously, recommendations for increased portfolio allocation to digital assets and heated rhetoric from an influential US president linking the Fed and Wall Street further stoked an environment conducive to risk assets, including cryptocurrencies.

Perhaps the most striking claim came from David Kobeissi‘s asset allocation newsletter.

“If the new Fed Chair actually cuts rates to 1%, we are going to witness perhaps one of the biggest runs of all time in stocks and real estate…”

The Kobeissi Letter

The concern highlighted is extraordinary, emphasizing the vulnerability of markets accustomed to historical norms where the Fed typically cuts rates during economic crises, which often coincide with or precede bear markets and falling asset prices. Applying such a rate cut ($4.25% to $1.00%) to unusually elevated valuation peaks could have severe ramifications.

In Conclusion

Bitcoin’s approach to the $107,000 handle was headline-grabbing, driven by both accumulated exchange liquidity pointing towards a potential short squeeze and bullish macro sentiment surrounding anticipated Fed policy changes (or lack thereof). Traders heading into the month and quarter end will be watching closely for strong action around the resistance zone. Whether this proves to be a temporary bounce or the catalyst for deeper appreciation remains uncertain, subject to real-time price action and evolving market conditions.

*(Disclaimer: This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research (DYOR) and consider their risk tolerance before making a decision.)*