In Brief

- U.S. President Donald Trump stated he is “not planning on doing anything” regarding Fed Chair Jerome Powell’s removal.

- Despite Trump’s months-long pressure, the Federal Reserve maintained its benchmark interest rate.

- Analysts suggest Trump’s reported efforts to oust Powell could potentially boost Bitcoin amid weakness in stocks and bonds.

U.S. President Donald Trump’s campaign to oust Federal Reserve Chair Jerome Powell heated up Wednesday, though Trump denied having a plan to fire him.

The Fed has resisted pressure from Trump and his allies to lower rates despite months of criticism.

According to reports, the Fed has held its benchmark rate steady this year to assess potential inflationary impacts.

On Wednesday’s remarks, when asked about potential action against Powell before his term ends in August 2026, Trump said:

“We’re not planning on doing anything. He’s doing a lousy job, but no, I’m not talking about that.”

Tension emerged as these comments contradicted a Bloomberg report suggesting Trump was poised to fire Powell soon.

In a Tuesday night meeting with Republican lawmakers at the White House, Trump showed them a draft letter designed to remove Powell, according to reports from The New York Times.

Trump has repeatedly called for lower interest rates to reduce the federal government’s debt burden.

If successful, removing Fed Chair Powell during his term would represent an unprecedented move. The legality of such action is unclear, though experts say it could severely damage confidence in the U.S. financial system and trigger market dislocation.

Some analysts argue that sowing doubt about Fed independence and the dollar’s role could benefit alternative stores of value like Bitcoin and gold.

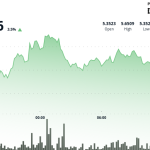

Bloomberg prices indicate Bitcoin trading near $119,500 following Trump’s comments.

Trump has expanded pressure on Powell beyond monetary policy, also criticizing the Federal Reserve’s $2.5 billion renovation plan for its headquarters.

When asked if the renovation could justify firing Powell, Trump responded: “I think it sort of is.”

These developments echo aspects of Trump’s “reciprocal” tariff policies from earlier this year.

This narrative unfolded alongside continuing trade discussions described in the original text.