Bitcoin Derivatives Market Reaches Record Highs Amid Elevated Leverage, ETF Influence

Key takeaways:

- Open interest in Bitcoin futures and options has ballooned to $96 billion, significantly exceeding 2022 levels.

- US spot Bitcoin ETFs introduced in 2024 accelerated market growth, marked by more volatile open interest changes reflecting heightened leverage.

- Elevated speculative leverage fuels price potential, raising the risk of liquidation events, while stablecoin-margined positions mitigate volatility.

The $96.2 billion open interest (OI) currently dominates Bitcoin’s derivatives market, exerting significant influence whenever the cryptocurrency trades near its all-time highs.

Open Interest Reaches Record High

Bitcoin (BTC) derivatives open interest, now standing at approximately $96.2 billion, remains below a $114 billion peak but still vastly exceeds its 2022 low.

Glassnode highlighted that the launch of U.S. spot Bitcoin ETFs in January 2024 significantly spurred this trend. Prior to this development, in 2023, open interest saw relatively stable fluctuations. Post-ETF adoption, however, the 30-day changes have increased significantly, reflecting a market more driven by leveraged trades.

This elevated speculative activity is captured by metrics like the Realized Cap Leverage Ratio, now sitting at 10.2%. This ratio ranks among the highest levels since 2018, indicating substantial margin usage and potential price volatility as Bitcoin navigates near all-time highs.

Leverage Amplifies Potential and Risk

This heightened leverage could drive rapid price appreciation past key resistance levels like $111,800, boosting liquidity and market engagement.

CryptoQuant data further indicates Binance achieved a significant milestone in May 2025, recording $1.7 trillion in futures trading volume – a new monthly high. This surge signals strong market speculation.

However, this same leverage carries significant caution. The risk of cascading liquidations looms large, potentially triggering sharp price drops, reminiscent of the 2021 volatility exacerbated by volatile crypto-margined positions.

Despite the risks, Glassnode noted signs of market maturity since the FTX collapse. Stablecoin-margined collateral now dominates over crypto-margined positions, reducing collateral volatility and offering a buffer against market shocks.

BTC-USDT Futures Leverage Ratio Points to Market Tensions

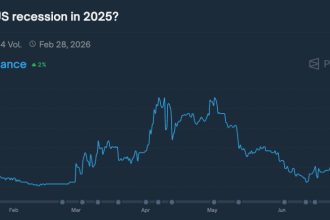

Data from CryptoQuant shows the BTC-USDT futures leverage ratio approaching its early-2025 peak while Bitcoin trades sideways above $100,000. This confirms the concerns about elevated leverage discussed earlier.

Crypto analyst Boris Vest pointed out that traders are preparing for potential directional moves. While short positions continue to increase on Binance, funding rates suggest a relatively balanced long-to-short ratio.

“Within the $100K–$110K range, most traders are leaning toward short positions. This increases the chances of a move in the opposite direction. It’s possible that larger players are quietly accumulating in this zone.”