Key elements suggest Bitcoin (BTC) is in an advanced stage of an upward trend, potentially targeting $160,000.

Confirmed Pattern Breakout

Bitcoin has confirmed an inverted head-and-shoulders pattern on both daily and weekly charts. This reversal formation, identified by chartists Merlijn the Trader and Trader Tardigrade, broke above support levels near $113,000 and $114,300-$115,600 respectively.

This breakout validates the pattern and sets the stage for a measured price increase. Short-term correction below $114,000-$115,000 is predicted to retest these former resistance levels as support.

Targets range from $140,000 to $160,000, contingent on a successful bounce from the neckline. Analyst Hardy anticipates the $114,300-$115,600 zone to provide crucial support before further gains.

Signals Indicate Rally Has Legs

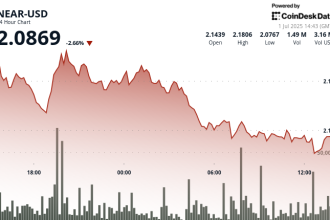

Recent gains from all-time highs just shy of $123,250 triggered a pullback, with BTC correcting approximately 5.65%. This occurred after days of strong price appreciation.

Technical indicators like the daily RSI crossing 70 suggest short-term upside exhaustion, but do not invalidate the overarching bullish structure.

On-chain data supports this, illustrating profit-taking by holders intent on locking in gains.

On-Chain Analysis Supports Thesis

The MVRV Z-Score, which compares market value to realized value, remains significantly below historical peaks. This signals Bitcoin may not be overvalued, contradicting levels traditionally associated with market tops.

If the current structure holds and the RSI correction completes, an extended move toward the IH&S targets in the $140,000-$160,000 range seems plausible, potentially by August or September.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.