Bitfarms Announces Share Buyback of Up to 10% of Public Float

Bitcoin mining company Bitfarms (Ticker: BITF, TSX/Nasdaq) announced today a share buyback program, authorizing the repurchase of up to 49.9 million common shares, representing approximately 10% of its current public float, over the next twelve months.

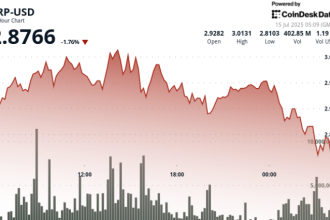

The Toronto Stock Exchange has approved the program. Repurchases occurring on the TSX are limited to a maximum of 494,918 shares per day, or approximately 25% of the average daily trading volume over the past six months. On the Nasdaq exchange, the total repurchases under the program cannot exceed 5% of the company’s outstanding shares. The buyback period commenced on July 28, 2025 and concludes on July 27, 2026. The company will acquire shares at prevailing market prices, and all repurchased shares will be subsequently canceled.

CEO Ben Gagnon stated the buyback reflects confidence in the company’s business prospects and indicates management believes the stock is currently undervalued. “This transaction is a clear reflection of our confidence in Bitfarms, and I believe the stock remains undervalued,” Gagnon noted via company press release.

Separately, Bitfarms announced key strategic developments. The company is executing a strategic pivot away from its traditional role as a Bitcoin miner towards powering high-performance computing (HPC) and artificial intelligence (AI) applications. This pivot aims to leverage its existing hardware, power, and cooling infrastructure.

Concurrently, Bitfarms has expanded its US operations, partly in response to trade war concerns. The company reported significant strategic shifts in its latest financial report. Despite a $36 million net loss in Q1 2025 (compared to a $6 million net loss in Q1 2024), Bitfarms highlighted its focus on this pivot. The gross profit margin declined year-over-year, from 43% in Q1 2024 to 63% in Q1 2025.

“During the quarter, we executed across several key areas in our strategic pivot to the US and HPC,” stated Gagnon.

In April, Bitfarms secured a crucial $300 million credit line from Macquarie to expand an HPC facility in Pennsylvania. The company also sold its Paraguay mining site for $85 million to Hive Digital. Furthermore, Bitfarms mined 693 Bitcoin during Q1 2025 at an average production cost of $47,800 per BTC.

The share buyback provides further capital deployment aimed at bolstering shareholder value during its strategic transformation.